Understanding your mortgage payments and how they work for you

What you’ll learn:

- The components of your mortgage payment

- How interest and principal costs change over the life of your loan

- What equity is and why it matters

- The fastest ways to build equity in your home

- How to save (a ton) of money on your mortgage

Mortgage payments can be confusing, whether you’re a first-time homeowner or have plenty of experience owning a home. But don’t worry — that’s normal! Most homeowners aren’t mortgage bankers or insurance brokers, so don’t be discouraged if you don’t understand the ins and outs of your mortgage payments.

If you’re still searching for a home, understanding what goes into a mortgage payment will help you decide what type of mortgage is right for you. But even if you’re already a homeowner, becoming more familiar with your mortgage payments can help you better understand your investment in your home and make decisions about whether or when it makes sense to refinance. Let’s dive in!

What's in a mortgage payment?

While you’ve probably heard that a mortgage payment is made up of principal and interest, you may have noticed some other charges on your monthly statement.

Don’t panic. These charges are normal. You often pay your lender for more than what you owe on your mortgage. Paying everything to your lender ensures that other important payments are made, which protects you as much as it protects your lender.

Depending on your loan, you may see some or all of the following as part of your mortgage payment:

- Principal: The sum of money you borrowed. When buying a house, this is typically the purchase price minus the down payment.

- Interest: Your interest rate is the cost of borrowing — your lender charges you a percentage on the money you borrowed. Interest is calculated using the remaining balance of your loan.

- Taxes: This is your annual property tax broken down into 12 monthly installments and held by your bank in escrow (a third-party, which holds assets or funds) to pay your tax assessment.

- Home insurance: Property insurance meant to cover your home, personal belongings, and liability. When you have a loan, your lender requires you to carry home insurance.

- Private mortgage insurance (PMI): If you put down less than 20% when you bought your home, you’ll almost certainly pay PMI. This additional insurance protects your lender in the event that you default on your mortgage. Typically, once you hit 20% equity on your home, you can have PMI removed.

- Homeowners association fee (HOA): If you live in a condo or townhouse, you will likely have an HOA. Your HOA fees pay for the upkeep of shared areas, like roofing, lawn care, and parking lots. Some single-family home communities also have an HOA.

Let’s look at an example. If you take out a $300,000 loan to buy your home, your first payment might look something like this:

| Principal | Interest | Taxes | Insurance | Total |

| $514 | $754 | $226 | $112 | $1,606 |

You probably noticed that your interest in this example is much higher than your principal. That’s also normal. Your loan payments go to interest owed first and the remainder goes toward the principal.

As you pay down the loan, the portion of your payment going to the principal gets bigger and the portion going to interest gets smaller. That’s because as the principal gets smaller, you owe interest on a smaller amount.

- Realm Tip: The faster you pay down your principal balance, the less you’ll pay in interest over the life of your loan.

What is amortization?

Amortization is the process of paying off a loan over a set period of time with regular or “periodic” payments. The payment is calculated so that the borrower pays a set amount each month. This is very useful because borrowers can understand and budget for their costs reliably.

Most mortgages are self-amortizing loans, meaning that both the principal and interest will be paid off fully with the last payment of the loan.

How to use an amortization calculator

If you’re still deciding what type of loan is right for you, an amortization calculator can be very helpful. Amortization calculators allow you to see the long-term cost of borrowing.

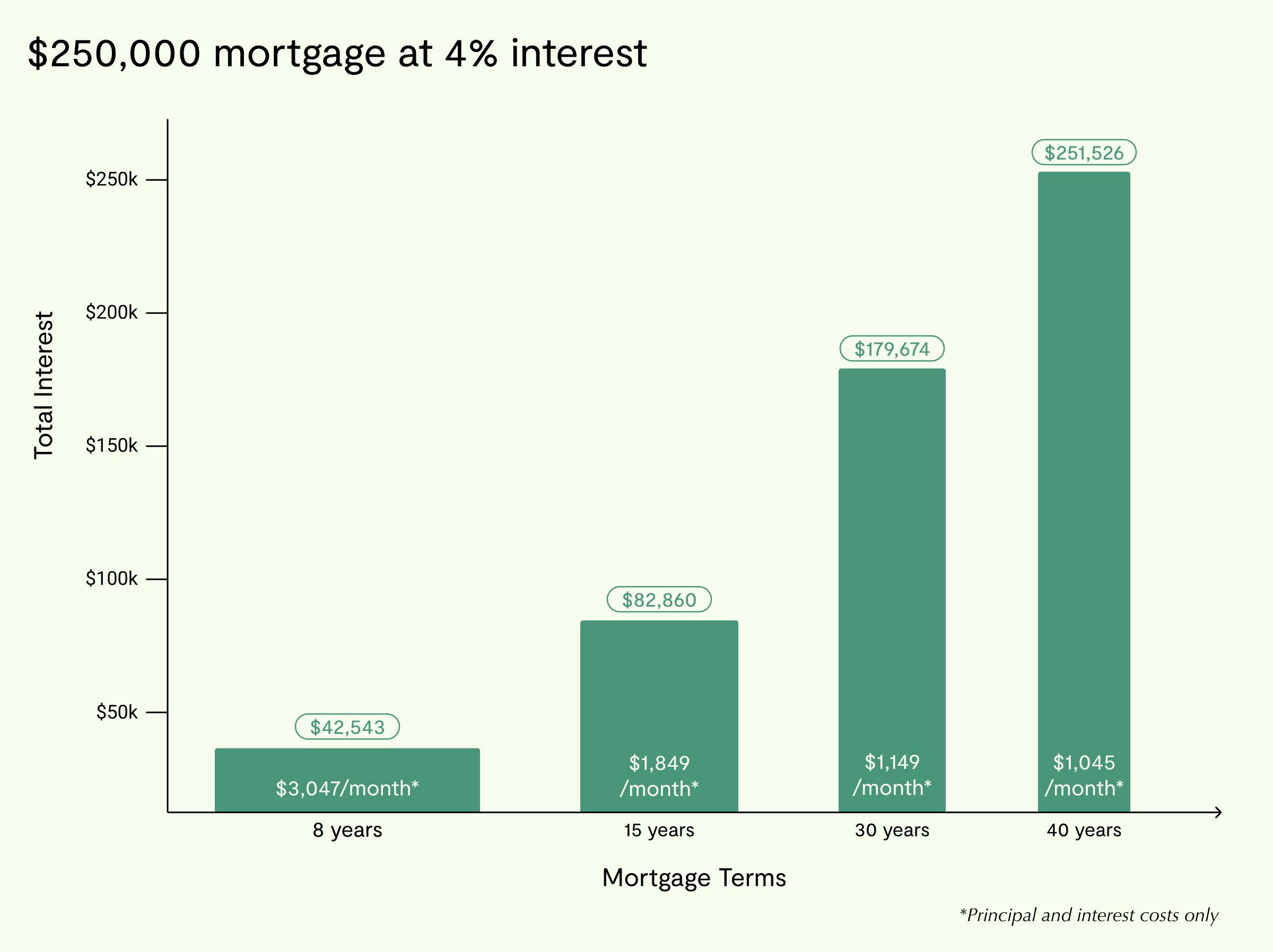

Most home loans are for 30 years, but 15-year loans are also widely available. Some lenders also offer loans as short as eight years, while some offer loans as long as 40 years.

The longer you take to pay back your mortgage, the more you’ll pay in total interest over the life of the loan. On the flip side, you could take on a shorter mortgage and pay less in total interest, but you’ll make higher monthly payments. It all comes down to how much money you have in the bank today versus how much you expect to have in the future.

Using the Realm amortization calculator, it’s easy to see how different mortgage terms impact your payments. Trying out different loan lengths will show you:

- How much you’ll be expected to pay each month

- How much you’ll pay in interest over the life of your loan

For example, look at the varying monthly costs versus total interest paid over the life of the loan when you have different mortgage terms:

As you can see, a 30-year mortgage has a cheaper monthly payment by more than $700. But it’s more than twice as expensive in the long run as a 15-year-mortgage with the same interest rate and principal amount.

What if you want to reduce the amount you pay overall but you can’t afford the monthly payments on a 15-year mortgage? You can always make extra payments to help reduce your overall, long-term costs.

What is an amortization schedule?

The Realm amortization calculator also includes an amortization schedule, also called an amortization table. This is a month-by-month breakdown showing the interest and principal for each payment over the life of your loan. Each monthly payment (or periodic payment) is the same, but the ratio of interest to principal changes.

An amortization schedule can be made for any type of installment loan with an end date. You can calculate a schedule for car loans, student loans, and mortgages.

Using amortization calculators with adjustable-rate vs. fixed-rate mortgages

Amortization calculators work best for calculating the payment amount and total costs of a fixed-rate mortgage. Adjustable-rate mortgages (ARM) work differently than fixed-rate. An ARM offers a fixed interest rate for a set period of time, but after that period, the interest rate fluctuates. With an ARM, after the fixed interest period, your interest rate can go up or down (and your monthly payments can change dramatically).

For example, a 10/1 ARM keeps the same interest rate for ten years. Then the interest rate adjusts annually and reflects the current interest rate each year. Because you don’t know what your interest rate will be over the life of your mortgage, you can’t get an accurate amortization schedule.

While an ARM has advantages (typically, they offer lower interest rates during the fixed period), a fixed-rate mortgage makes it possible to understand the total cost of your loan — the principal and amount of interest you’ll be expected to pay. With a fixed-rate mortgage, it’s also much easier to understand the value of faster repayment and whether refinancing is a good option.

See how much you've invested in your home

Why does amortization matter?

When you first start to make monthly mortgage payments, you pay more in interest than you do on the principal. Your interest payment goes to your lender — that’s how lenders make money from loans. Your principal payment goes toward your share of ownership in the house, which is called equity. When your principal is paid off completely, you own your house outright.

Equity = current value of your home - amount you owe

As you progress through your loan payments, you start to gain equity faster and faster. Why? Because the more payments you make, the more you’re paying toward principal. And as your principal decreases, you pay interest on a smaller amount of money. For example, three percent interest on $300,000 ($9,000) is much more than three percent on $30,000 ($900).

But even though the amount you pay in interest is decreasing — and here’s the important part — your mortgage payment stays the same. So a larger percentage of your payment goes toward the principal. That means you are gaining equity and paying down your loan faster. The faster you pay your loan, the less you pay in interest.

The easiest way to understand this concept is to look at an example. Let’s compare your first mortgage payment with your final mortgage payment on that same $300,000 loan:

| Payment | Principal | Interest | Taxes | Insurance | Total |

| First | $515 | $750 | $226 | $112 | $1,603 |

| Last | $1,262 | $3 | $226 | $112 | $1,603 |

Keep in mind that this is a general calculation — chances are that your taxes and insurance expenses won’t stay the same over your 30-year loan. Even still, you can see how drastically your principal and interest payments change over time.

Curious to see how much equity you’ve built in your home? Enter your current mortgage terms into your free Realm dashboard and we’ll calculate it for you.

How to make amortization work for you

If you’d like to pay less in interest and gain equity faster, you can make extra payments on your loans. When you make extra payments, those payments go toward paying down the loan balance (aka principal). The smaller the loan balance, the less you pay in interest.

Even an extra $100 month can save you more than you’d think. Using the earlier example, if you have a 30-year fixed loan at 3% interest for $300,000, you’ll pay $155,332 in interest over the life of your loan. By adding an extra $100 to your monthly payment, you’ll save $19,437 in interest over the life of the loan — that’s a big savings!

- Realm Tip: Extra payments aren’t the only way to reduce your interest payment. You can also refinance your loan to lower the cost of total interest. Learn more about refinancing and try out the Realm refinancing calculator here to see if lowering your interest rate would be worth the cost of refinancing.

Building your equity

Making extra payments toward your mortgage can help you lower the overall cost of your loan and build equity faster. But there’s another way to build equity in your home. Remember this?

Equity = current value of your home - amount you owe

You can increase your equity by paying down your principal balance and reducing the amount you owe. But you could also increase your equity by boosting the current value of your home. Typically, your home’s value increases over time. But you can also add home value with upgrades or renovations.

Realm’s Project Planner is a great way to explore projects that will increase how much your home is worth. When you add projects in Realm, you can easily see:

- The estimated cost of the project

- The estimated value added to your home

- The estimated recoup on your investment

For example, let’s say the current value of your home is $300,000 and you owe $200,000 in principal. Your current equity is $100,000.

Equity = $300,000 - $200,000 = $100,000

Now, imagine you’re thinking about a bathroom renovation. When you add a bathroom renovation in your Realm Project Plan, you see that it will cost you about $10,000. And in your area, that project increases your home’s value by $12,500. So now, your equity looks like this:

Equity = $300,000 +12,500 - $200,000 = $112,500

You’ve increased your equity by the full $12,500!

All of Realm’s estimates are based on unbiased data and are specific to your location, so you can feel confident that you’re making the right decisions. And when you customize your projects, you can see how choosing specific materials or finishes, like a custom vs. a stock vanity for your new bathroom, changes the overall cost and the return on your investment.

Tracking your mortgage with Realm

The Realm dashboard can also help you keep tabs on your mortgage and the equity you’ve built in your home. When you enter your loan details in the dashboard, not only do you get information about your current mortgage, you can also see whether you’re overpaying. Realm searches for the most competitive interest rates based on your information. If we can find a competitor offering a better rate, your dashboard shows you exactly how much you could save.

Being able to see your current equity also allows you to assess your options if you’re looking to borrow against that equity. When you’re in your free dashboard, you can get an accurate estimate of the funds accessible to you through your equity — which is really helpful if you’re considering borrowing money to finance renovations.

Having a clear picture of your mortgage and all that goes into your monthly payments is one of the many ways that Realm helps you become a smarter homeowner.

Frequently Asked Questions

How many years come off my mortgage by paying extra?

That depends on the principal balance of your loan, your interest rate, and how much you’re paying extra. If you have a $250,000 loan at 4% interest and pay an extra $100, you’ll pay off your loan four years and one month earlier. An extra $500 payment each month shortens your loan by 13 years. And an extra $1,000 shortens it by 18 years.

Is there any reason why you shouldn't pay off your house early?

There are a few scenarios that should take precedence over paying off your mortgage:

- You have high-interest debt, like balances on credit cards

- You don’t have a six-month emergency fund

- Your mortgage interest tax-deduction is too valuable

- Prepayment penalties make it unprofitable to pay early

How do you figure out an amortization schedule?

You can use the Realm amortization calculator and amortization schedule above. Your lender should also provide you with one.

Do extra payments automatically go to principal?

As long as you’ve made your regular monthly mortgage payments, extra payments should go toward your loan principal. But it’s always a good idea to specify with your lender that you want your extra payment to go toward principal. And remember: these extra payments don't lower your usual monthly payment. Instead, they decrease the amount you owe and help you build equity faster.

Published by Realm

Get more out of your biggest asset: your home. Realm shows you what your home could be worth & how to access more of its potential value. View more posts