How much house can I afford?

What you'll learn:

- Mortgage basics

- Types of mortgages

- The difference between principal and interest

- What home equity is and why it's important

- How to use home equity to finance home projects

Imagine you’ve been searching for a new home for months. You’ve toured more houses than you can count, but keep striking out. One wasn’t the right layout, while another was too far from your desired neighborhood. And in a competitive housing market, many were probably snatched up before you could even decide whether to make an offer.

Now, after all that work, you’ve found the one — a home with good bones, lots of style potential, and plenty of space on the lot. Plus, it’s in the perfect location. It’s everything you hoped to find when you first set out on your house hunting journey. But there’s one all-important question: Can you afford your dream house?

Buying a home is an emotional experience, but it’s also a huge financial investment. In fact, on average, a home accounts for 62% of the average American’s assets. That’s a big investment! Knowing how much house you can reasonably afford can help you focus your search. Why waste time touring (or falling in love with) homes that are outside of your budget? Beyond that, understanding how a mortgage and equity work — and how they can work for you — will help you make smart choices when purchasing a home.

There are many factors that go into figuring out how much you should spend on a home, including:

- Income: As you might expect, how much you make has a big impact on how much you can spend.

- Monthly debts: If you make monthly payments toward student loans, a personal credit card, or a car, those payments need to be factored in when calculating how much to spend on a home.

- Down payment amount: How much you put down in cash will help determine your overall spending budget and your mortgage interest rates.

- Credit score: A higher credit score will demonstrate to lenders that they can have confidence loaning you money — which means you’ll be able to borrow and spend more on a home.

Another important factor is your debt-to-income ratio, or DTI ratio. Your DTI ratio compares your total monthly debts, including your mortgage payment, to your monthly pre-tax income.

Mortgage lenders use this metric to assess whether you’re asking to borrow a reasonable amount (or are stretching your budget too thin). As a general rule of thumb, your housing costs shouldn’t be more than 28% of your monthly income.

For example, let’s say your monthly income is $4000. To figure out your DTI ratio you’d take $4000 x .28 or $1120. That means that your mortgage payment — including interest, taxes, and home insurance — shouldn’t exceed $1120.

What is a mortgage?

While knowing how much you can spend on a home is a good place to start, it’s also helpful to understand some key concepts and terms you’ll encounter on your journey to homeownership.

Even if you just started researching what it takes to buy a home, you’ve probably heard of a mortgage. At its most basic, a mortgage is simply a very big loan. More specifically, it’s a financial agreement between a homeowner and a bank (or lender). The loan allows a borrower to make a large purchase — like a home — that they wouldn’t have enough money to buy outright. Then, the borrower pays back the lender over a long period of time until eventually, they own their home without any debt to the bank.

So what’s in it for the lender? Interest and collateral. As the homeowner makes monthly mortgage (or loan) payments, the lender collects interest on those payments. Interest is the fee the bank charges for lending you the money. If a borrower fails to make their mortgage payments, the bank has the home as collateral. In other words, the lender can foreclose on your home (i.e. take it from you) if you don’t make your scheduled mortgage payments — which is very important information to know when getting a mortgage.

Types of mortgages

When you’re ready to buy a house and take on a mortgage, you’ll discover that not all loan terms are the same. Most frequently, you’ll see 15-year and 30-year mortgages, meaning you pay back the loan over those time frames, respectively.

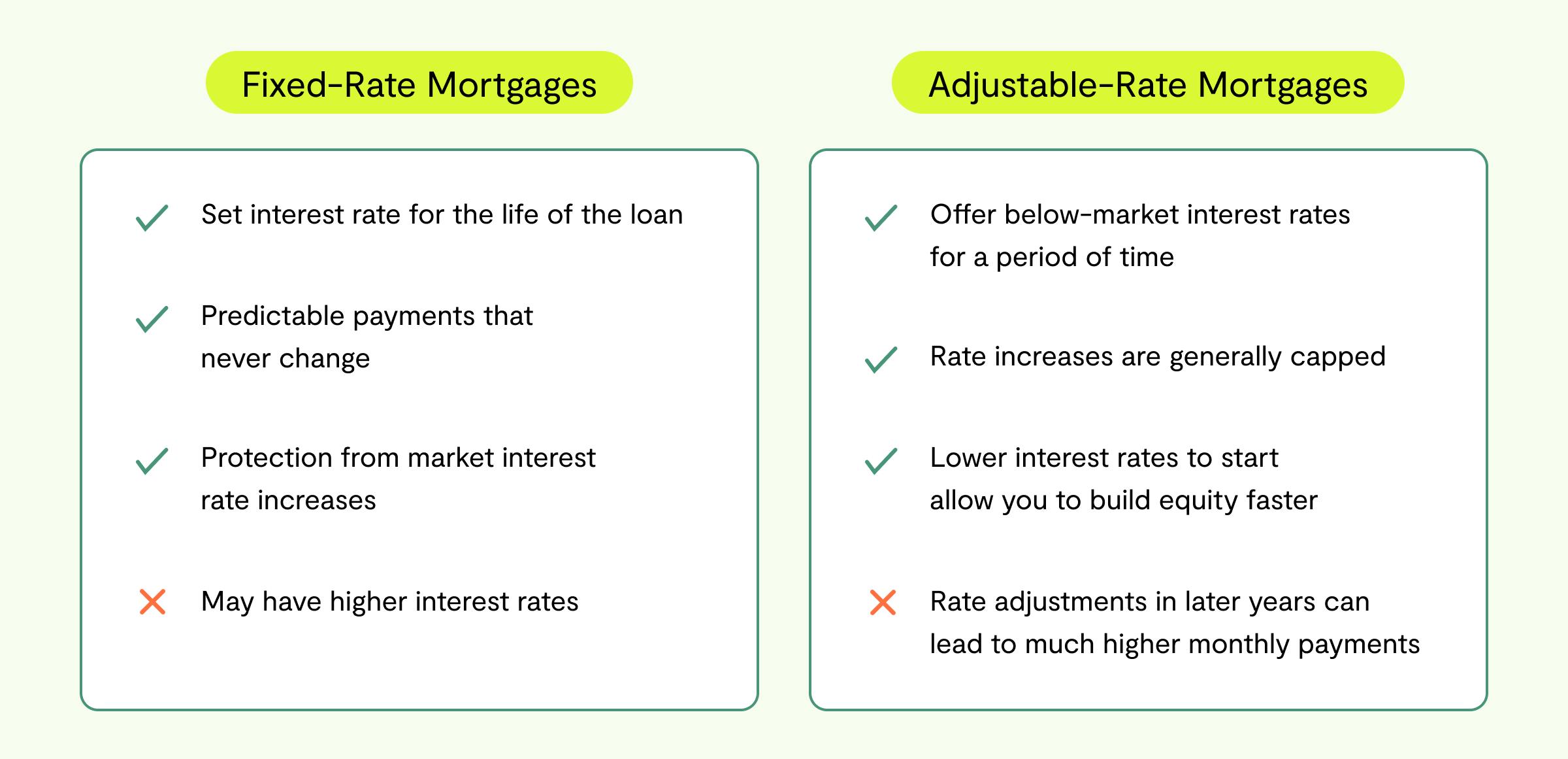

You’ll also see that interest rates vary from loan to loan. While interest rates fluctuate based on the market and your personal financial profile (credit score, income, down payment amount, etc.), they also differ based on the type of mortgage. Two common types are fixed-rate mortgages and adjustable-rate mortgages.

When you get a fixed-rate mortgage, your interest rate remains the same over the entire lifespan of the loan. With an adjustable-rate mortgage, your interest rate starts off fixed, but after a set amount of time, the bank can adjust the rate periodically to reflect current market interest rates. Adjustable-rate mortgages may begin with lower interest rates, making them seem like the better option, but the rates can rise significantly later on — making your loan more expensive. Regardless of which type of mortgage you get, it’s important to understand all the terms and details before you sign on the dotted line. If you need help understanding the fine print, talk to your mortgage broker or another financial advisor.

Principal vs. interest

If interest is the bank’s charge for loaning you the money, what’s principal? It’s the original amount you borrow to buy your home. Let’s consider an example:

Imagine your home costs $300,000. If you make a 20% down payment of $60,000, your principal is $300,000 - $60,000 or $240,000. That’s how much the bank loans you to allow you to purchase the home.

- Keep in mind: While a 20% down payment is common, there are situations and loan programs that allow you to make smaller down payments — and you can always make a larger down payment if you want to borrow less.

So your principal is the actual loan amount from the bank. Why does this matter? Well, when the time comes to make your first mortgage payment, you’ll see that the two main components of the payment are principal and interest. As soon as you borrow from the bank, your principal begins to accrue interest. When you start making loan payments, you’re paying back some of your principal, which chips away at your loan, and some of your interest, which goes to the bank.

- Realm tip: Many first-time homebuyers don’t realize that for the first several years, your mortgage payments are heavily weighted toward interest. That means that although you’re making regular payments, most of your money is going to the bank and your loan amount (or principal) isn’t decreasing much. To get a clear picture of how your mortgage payments will be distributed over time, review the amortization schedule provided by your lender.

What is equity?

One of the most important — and most powerful — concepts for homeowners to understand is home equity.

Equity = Current value of your home - amount you owe

When you buy your home, your equity is essentially the cost of the home minus your down payment. For example, let’s say you buy a $350,000 home and put down 20% or $70,000, and you take out a mortgage for $280,000.

Equity when purchased = $350,000 - $280,000 = $70,000

So your equity when you buy your home is $70,000 (or your down payment).

But equity can grow over time. How? Two main factors impact equity: paying down your principal and increases in your home’s value. Let’s look at these equity levers one at a time.

Take the same home you originally purchased for $350,000 with a $70,000 down payment and a $280,000 mortgage. Imagine you’ve been making mortgage payments for several years and you’ve made a dent in your principal. Now you only owe $250,000 and your equity would look like this:

Equity after several years of payments = $350,000 - $250,000 = $100,000

By making regular mortgage payments, you’ve increased your equity by $30,000.

The other factor that can impact equity is your home’s value. Let’s take the same example again. You buy a $350,000 with 20% down payment and a mortgage of $280,000:

Equity when purchased = $350,000 - $280,000 = $70,000

Now imagine that the national housing market is booming and homes in your neighborhood have become quite desirable. Your home, which you purchased for $350,000, is now valued at $400,000. Without even considering any mortgage payments you’ve made, here’s how that increased home value would impact your equity:

Equity after home value increase = $400,000 - $280,000 = $120,000

- Keep in mind: While home value can be a powerful tool to build equity, it’s also important to remember that housing markets typically grow slowly and can fluctuate year to year. In some years, it’s even possible for your home to lose value, which can diminish your equity.

Why is home equity important?

Home equity can be a crucial savings tool. As you make mortgage payments and build equity in your home, you’re essentially dropping money into a savings account. It doesn’t happen overnight, but the longer you own your home and the more monthly payments you make toward your mortgage principal, the more you save.

When you’re ready to sell, all that equity comes back to you as profit. If you’re looking for a new home, you could use that money to make your next down payment. Or it could provide financial support in retirement. It’s up to you to choose how to use the wealth built through homeownership.

Use equity to finance home projects

Cashing out when you sell is one way to take advantage of your home equity. But there’s another way to use your equity while you’re still in your home — and it can even help you increase your home’s value.

As you build equity, you can borrow from that equity to finance renovations and other projects. Borrowing against your home equity allows you to make upgrades to your home without having to pay out of pocket. At the same time, home projects can add value to your home, further increasing your equity. It’s a win-win!

While there are several ways to tap into your equity, these are three of the most common borrowing options:

- Home equity loan: A home equity loan is exactly what it sounds like — you borrow a lump sum from the equity you’ve built and pay back that loan with interest over a set period of time. Just like with your mortgage, your home is the collateral. Usually, you can borrow up to 85% of your home equity, although things like income and credit history will also be factors.

- Home equity line of credit (HELOC): A HELOC differs from a home equity loan in that you’re not taking out a set amount of money. Instead, you get approved for a credit amount that you can borrow from when and as you need to — very similar to a credit card. Like with a home equity loan, you will pay interest on what you borrow and your home is collateral for the loan. But with a HELOC, you only pay back what you use.

- Cash-out refinance: With this option, you use your equity to get an entirely new mortgage for a larger amount than your existing mortgage. You get the difference between the mortgage amounts in cash, which you can use to fund projects.

Remember, these aren’t one-size-fits-all borrowing options. Each type of loan has pros and cons, different fees, and unique tax implications. Visit Realm’s free-to-use financing hub to see rates and explore your options.

Choosing projects that increase home value

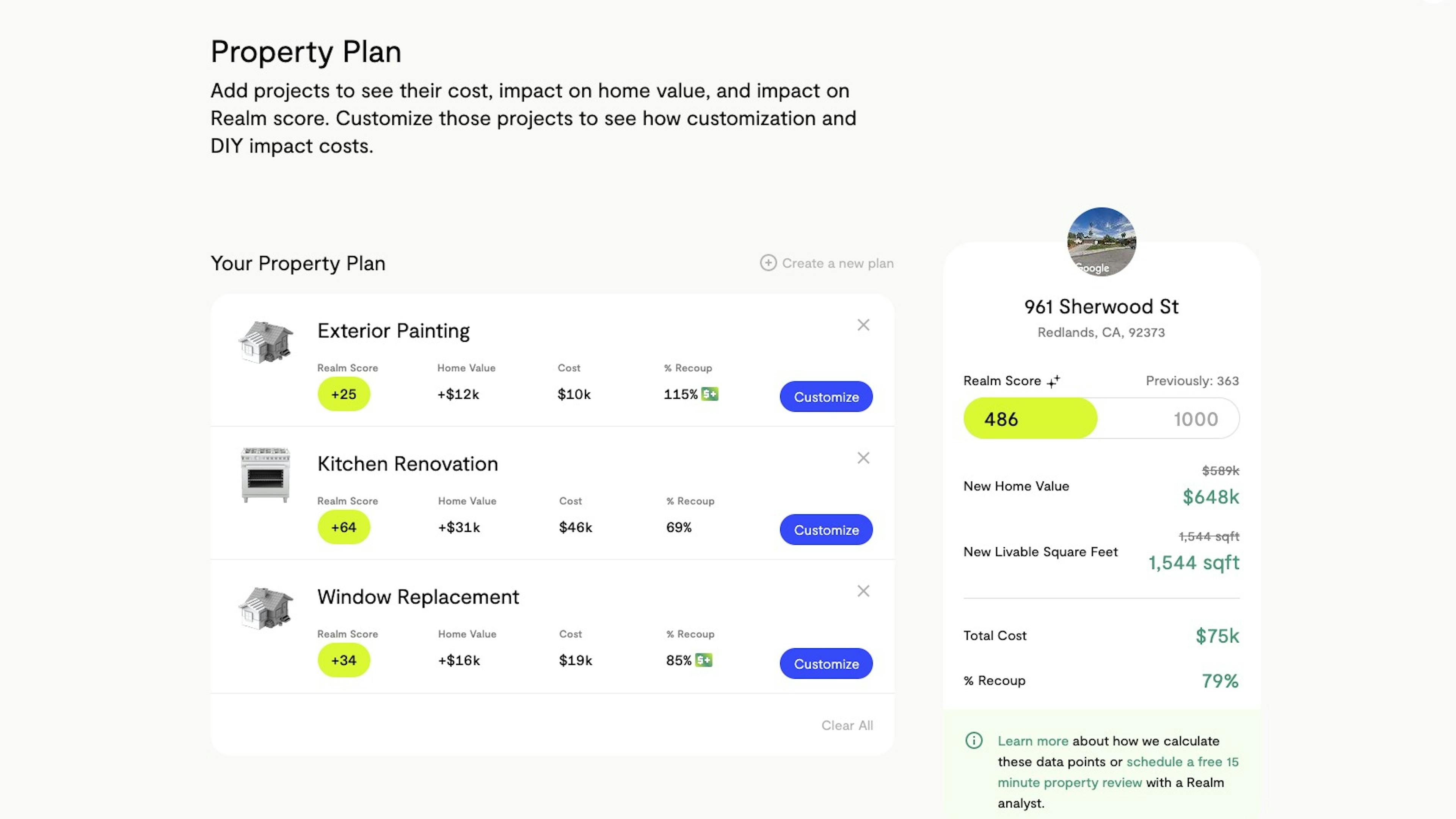

If you’ve decided to borrow against your equity to finance a home project, it makes sense to want to make the most of that loan. But how do you know which projects will have the biggest impact on your home’s value, helping you build even more equity?

Realm’s free dashboard gives you accurate cost estimates and return on investment for dozens of projects, all tailored to your specific property. We use proprietary data to show you how much a particular project will cost in your neighborhood and how much value it will add based on trends in your local area. Then, you can use Realm’s unbiased, customized estimates as benchmarks when you start navigating who to hire and how much to spend.

The Realm dashboard also helps you make decisions about your renovation budget. Deciding whether to splurge on granite countertops in your new kitchen? Or trying to figure out what type of material to use for your new roof? Our tools allow you to customize each project so you can easily see how different materials and finishes affect cost and ROI.

Hidden home potential

Even if you’re still house hunting, Realm can help you in your search — and may even open up new possibilities. If you know how much house you can afford but feel boxed in by your budget, using the Realm dashboard can help you rethink your search. With Realm, you can explore potential homes and easily see how much renovations or projects would cost and the value they’d add to the home. You can also accurately assess whether a fixer-upper is worth the investment it will take to make it livable.

Knowing how much house you can afford is a great way to begin your search for a new home. Using Realm while you house hunt gives you the tools to see which homes have untapped value and might deserve a second look. Log in to start exploring homes today.

Frequently asked questions

How do I calculate how much I can afford to spend on a house?

Realm’s home affordability calculator takes into account many financial factors, including your income, monthly debts, credit score, and down payment amount. Entering accurate information gives you a better sense of how much house you can afford.

How much house can I afford with my salary?

Your salary will have an impact on how much you can spend on a home. But it’s not the only factor. For example, if you have a large down payment set aside, you may be able to buy a more expensive home. And of course, the housing market in your area will have a large impact on how much you can afford to buy with your income.

How much do I need to make to afford a $400,000 (or $200,000, or $300,000) home?

This depends on your personal financial details. Using the home affordability calculator will give you a clear picture of what you can afford. You can also experiment with the calculator, trying different entries for income, down payment, etc. Understanding what it takes to buy your dream home is the first step toward getting it.

How much can I spend on a home if I make $50,000 (or $100,000 or $150,000)?

When applying for a mortgage, a lender will consider your debt to income ratio, or DTI ratio, which compares the amount you’re going to spend on housing costs to your monthly pre-tax income. In general, lenders prefer a DTI ratio of 28% or less. So if you make $50,000, your monthly pre-tax income is about $4167 and you wouldn’t want to spend more than 28% of that each month on housing costs — or a monthly mortgage payment of $1167. Entering your financial details in our home affordability calculator will show you how much you can spend depending on your salary.

How much house can I afford on $60,000 a year?

Your income is a critical component when calculating how much house you can afford. But the purchasing power of your salary depends on many things — not least of which is where you want to buy a home. A salary of $60,000 buys a much different home in Denver than it does in San Diego. Explore homes in different cities that fit your budget with our home affordability calculator.

Published by Realm

Get more out of your biggest asset: your home. Realm shows you what your home could be worth & how to access more of its potential value. View more posts