Reach your renovation goals with a HELOC

What you’ll learn:

- The basics of home equity

- How a HELOC uses your equity

- Key terms when considering a HELOC

- How a HELOC compares to other equity loans

One of the major surprises many people face after buying a home is the realization that it requires constant upkeep. Talk to a longtime homeowner and they’ll tell you that year in and year out, there’s always something (or things!) that needs attention.

Some projects are fairly minor, but others can cost thousands or tens of thousands of dollars. That’s a lot of money, even if you’re a diligent saver. For example, the average cost to replace your roof is $8,730. The average cost to replace your windows is nearly double that, coming in at $16,905. And the typical, mid-range kitchen renovation? On average, that will set you back $40,705. Any one of these projects may be too much for your rainy day fund to absorb. So what can you do?

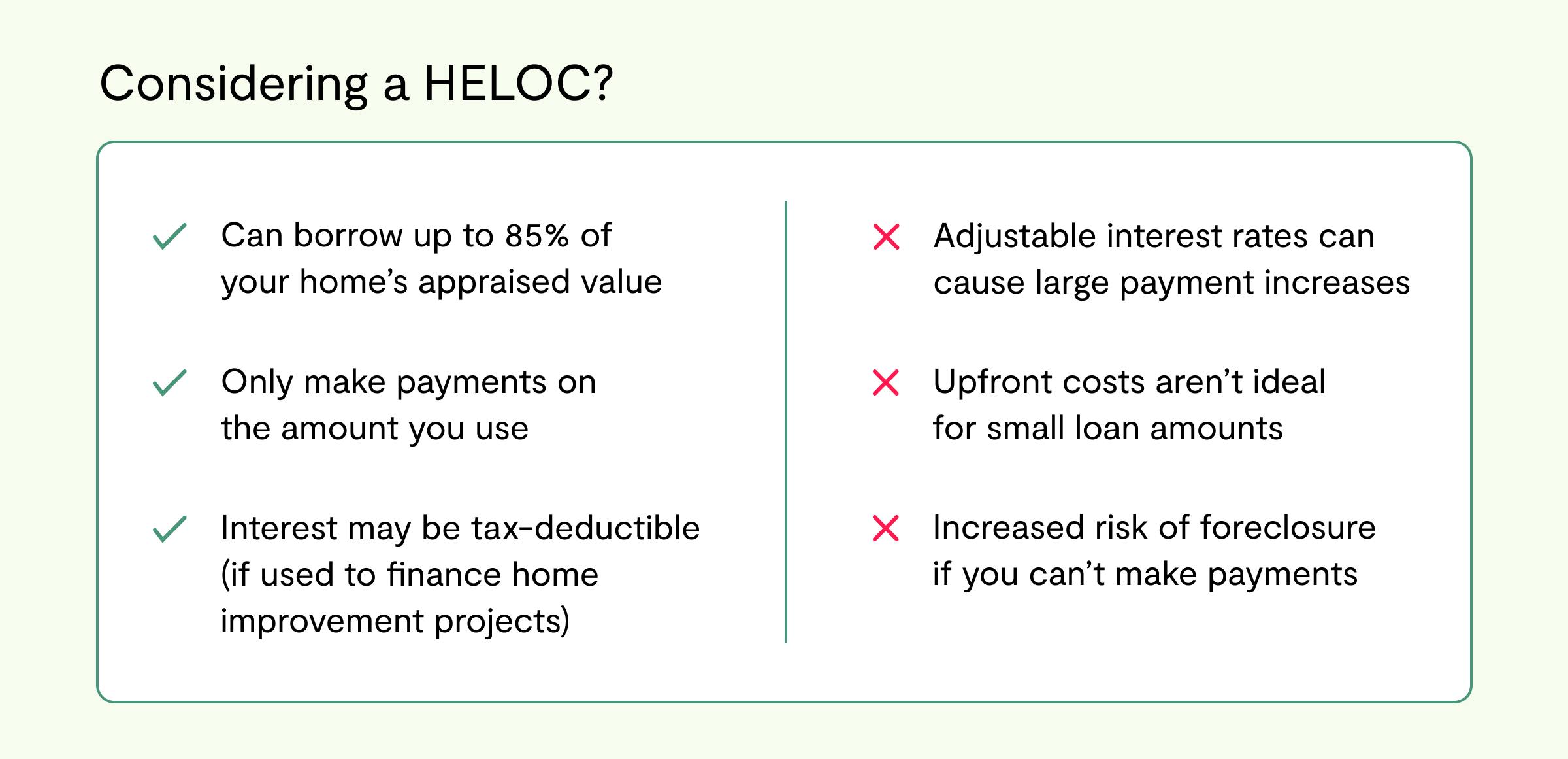

Well, here’s another surprise about homeownership: Your home itself may offer a solution. There’s a way to borrow against the equity in your home using a financial tool called a home equity line of credit (HELOC). Depending on when you bought your home and how much you’ve paid down your mortgage, you may be qualified to borrow up to 85% of the appraised value of your home to fund repairs and renovations. Here, we’ll get into the nitty gritty of HELOCs and how they can work for you.

Understanding home equity

The first step to understanding a HELOC is to understand home equity.

- Home equity is the difference between your home's market value and your outstanding mortgage balance.

Say you purchased your home for $400,000 with a downpayment of $80,000 and a mortgage of $320,000. Right off the bat, you have $80,000 equity in the home. That’s how much money you’d pocket if you sold your home immediately (of course, without subtracting bank, legal, and real estate fees).

As you pay down your mortgage each month, a portion of your payment goes toward the interest while the remainder goes to pay off the principal amount — in this case, $320,000.

Now imagine you’ve been making regular mortgage payments for a few years and you’ve paid down $20,000 on the original mortgage. So your outstanding mortgage balance is $300,000 and your equity looks like this:

$400,000 (home value) - $300,000 (outstanding mortgage amount) = $100,000 in equity

By making regular mortgage payments and chipping away at your principal, your equity has grown from $80,000 to $100,000. (For a full explanation of home equity, check out How much house can I afford?)

A HELOC lets you borrow from your equity to finance renovations and other projects without having to pay out of pocket. This is a win-win because many home renovation projects add value to your home and potentially increase its sale price, which further increases your equity.

Realm’s free-to-use dashboard is a great place to explore your equity. When you enter your current mortgage details, you can easily see how much equity you’ve built in your home.

Explore your home's equity

So what exactly is a HELOC?

A HELOC (home equity line of credit) is a revolving line of credit, much like a credit card, secured by the equity in your home. You can borrow as much as you need — up to your approved maximum — anytime you need it by writing a check or using a credit card connected to the account. Because a HELOC is a line of credit, you make payments only on the amount you actually borrow, not the full amount available to you.

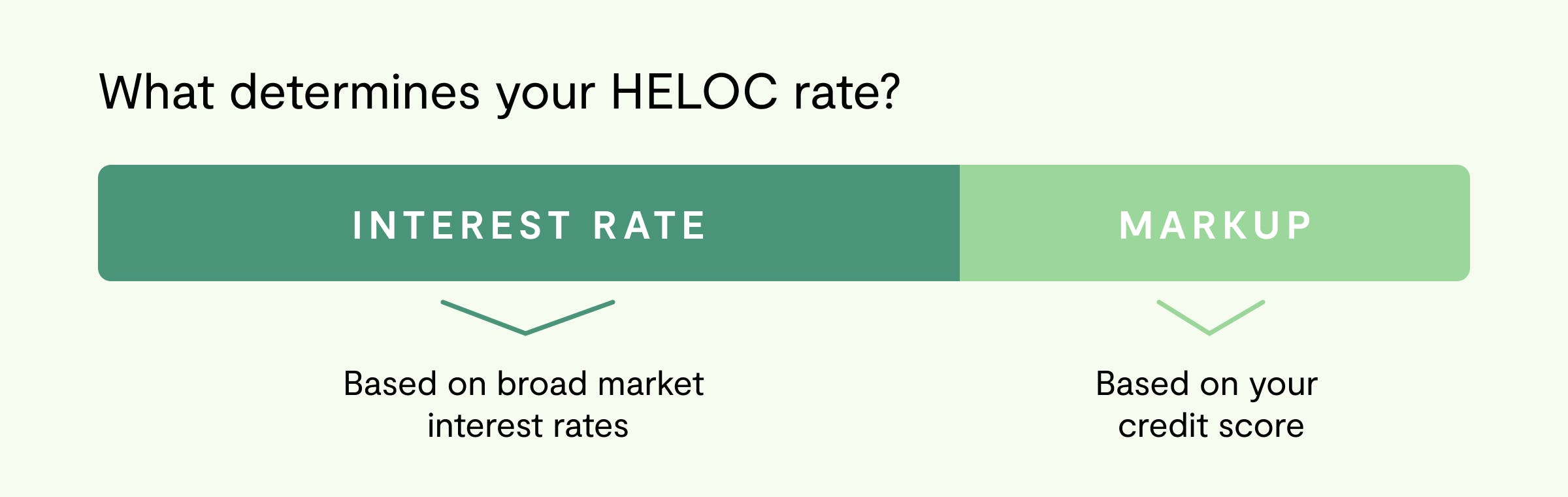

Most HELOCs have adjustable interest rates. These are tied (or indexed) to broader market interest rates. In particular, HELOC rates are tied to the federal funds rate, which is set by the Federal Reserve. So what does that mean? It means that when the federal funds rate goes up or down, HELOC interest rates follow and go up or down, too. To determine your initial HELOC interest rate, the lender adds a markup, called a margin, to the index. Your rate is based on your creditworthiness — the higher your credit score, the lower your rate.

It’s not unusual for initial interest rates on adjustable-rate HELOCs to start low and then rise. Fixed interest rates, if available, may be slightly higher than variable rates at first, but the monthly payments remain the same over the life of the credit line.

The HELOC application process is very similar to applying for a mortgage and requires the same documentation and fees, including an application fee, title search, appraisal, attorneys’ fees, and points (a percentage of the amount you borrow). These expenses can add substantially to the cost of your loan, especially if you ultimately don’t borrow much from your credit line, so it’s important to do the math. Using a HELOC to borrow small amounts may not be worth it because of the upfront costs and fees.

In its guidance to consumers about home equity loans, the Federal Trade Commission urges homeowners to compare loan plans from various lenders, including banks, credit unions, savings and loans, and mortgage companies. They also encourage borrowers to be transparent about the vetting process. Telling lenders that you’re shopping around will help you get a better deal, as they’ll compete for your business. You can even ask one lender to match or beat another lender’s offer.

To see how much you could borrow with a HELOC, check out your Realm dashboard. After you enter your current mortgage details, you’ll get an accurate estimate of your potential HELOC borrowing power, as well as current rate estimates.

Diving deeper into HELOCs

It’s not just the funky acronym that’s confusing — there’s a lot of industry jargon. But if you’re thinking about applying for a HELOC, it’s important to understand these terms so you go into conversations with lenders informed and able to get the best loan for your needs. Here’s a brief rundown of terms you should know:

Draw period: A HELOC has two phases — the draw period and the repayment period. During the draw period, often 10 years, you can borrow from the credit line by check, electronic funds transfer, or a credit card linked to the account. Monthly minimum payments are often interest-only during the draw period, but you can pay principal if you wish.

Repayment period: During this period, you can no longer borrow against the credit line. Instead, you pay back your loan in monthly installments that include principal and interest. With the addition of principal, the monthly payments can rise sharply compared to the draw period. The length of the repayment period varies, though it’s often 20 years.

Balloon payment: At the end of the loan, you could owe a large lump sum — or balloon payment — that covers any principal not paid during the life of the loan. Before you close on a HELOC, consider negotiating a term extension or refinance option so that you're covered if you can't afford the lump sum payment.

Periodic cap: How much the interest rate can rise in any one period of time.

Lifetime cap: The highest interest rate you could be charged over the life of the loan.

Both periodic and lifetime caps will tell you how high your payments could get and whether you will be able to afford them if the rate rises to its maximum.

Comparing HELOCs, home equity loans, and cash-out refinancing

A HELOC isn’t the only way to borrow against the equity in your home. You can also choose to use the similarly named (but totally different) home equity loan or a cash-out refinance. All of these options have pros and cons. Finding the right option depends on your specific financial situation and needs.

To figure out what’s best for you, it’s always advisable to speak to a financial professional. Understanding the different loan products will help you better navigate your options and conversations with financial pros and lenders:

Home equity loan: Many people confuse home equity loans with HELOCs. While they are similar, they’re different in crucial ways.

- Structure: A home equity loan is a loan for a lump sum amount, whereas a HELOC is structured like a revolving credit line. Both use home equity as collateral for the loan. With a home equity loan, you repay the loan with equal monthly payments over a fixed term, just like your original mortgage. In fact, it is another mortgage. And if you don’t repay the loan as agreed, your lender can foreclose on your home.

- Loan Amount: As with a HELOC, the actual amount you are allowed to borrow depends on your income, credit history, and the market value of your home.

- Rates: A home equity loan usually carries a fixed interest rate, which can provide more stability over the life of the loan and is useful for budgeting purposes. HELOCs often have adjustable interest rates.

Cash-out refinance: A cash-out refinance is a mortgage refinancing option in which you replace your current mortgage with a new one for a larger amount than you previously owed. The borrower gets the difference between the mortgage amounts in cash. You can learn more about cash-out refinancing here.

Each type of loan has pros and cons, different fees, and unique tax implications. They aren’t one size fits all. One thing to keep in mind: no matter which option you choose, you shouldn’t use your home equity to fund non-essential projects, like vacations or a new car. Although home equity is a powerful financing tool, these loans aren’t free. Each option is a form of debt (with its own costs) that you’ll have to repay, whether through a monthly payment plan or when you sell your home.

Instead, financial professionals recommend reserving your equity for projects that allow you to keep building wealth, like home renovations that increase the value of your home or consolidating higher-interest debt. The Realm project planner lets you prioritize potential renovations, get accurate cost estimates, and see how much value each project will add to your home.

Planning properly for your HELOC

If you’re interested in a HELOC, you can use the Realm dashboard to see your equity balance and HELOC borrowing options.

You can also use Realm to build a renovation budget. Knowing which projects you want to tackle and how much they’ll cost will ensure that you borrow the right amount with your HELOC. For instance, if you want to use a HELOC to finance a bathroom renovation and a new deck, you can add and customize those projects in your Realm dashboard and get an accurate cost estimate.

Having a budget in-hand will help as you discuss your projects with potential contractors. And, an accurate project budget will arm you with the knowledge you need as you discuss your HELOC with potential lenders.

Frequently asked questions

Do you have to pay taxes on a HELOC?

It depends on what you use the money for. If you are using it for home upgrades that add to your home’s value, it is not considered income and therefore is not taxed.

Is a HELOC like a credit card?

It functions like a credit card in that when you’re approved for a HELOC, you’re allowed a certain maximum amount of credit, which you can access with a credit card, check, or electronic funds transfer. As with a credit card, you have to make a minimum monthly payment on the amount you borrow.

Do you have to get an appraisal for a home equity line of credit?

Yes, you will have to pay for a home appraisal as part of the application process, just as you do when applying for a mortgage.

Can you pay back a HELOC early?

Yes, you can pay off your HELOC at any time without incurring prepayment penalties.

What happens if you don't use your HELOC?

Nothing. You can just keep it there as an emergency fund. The debt is sometimes tax-deductible, which is very convenient if you are looking to consolidate credit cards and other high-interest-rate debt that is not tax-deductible. Talk with a qualified accountant to learn more.

Published by Realm

Get more out of your biggest asset: your home. Realm shows you what your home could be worth & how to access more of its potential value. View more posts