Should I refinance my mortgage?

What you’ll learn:

- What it means to refinance your mortgage

- Reasons why you might want to refinance

- Costs and fees associated with refinancing

- Other factors to consider

- How Realm can help you decide if refinancing is right for you

If you’ve heard anything about mortgage rates recently, you might have heard people talking about how low they’ve been. You also might have heard folks talking about how those low interest rates make it a great time to refinance your mortgage. And while it’s true that low interest rates can be a good opportunity for some people to refinance, you might not be sure whether refinancing is the right option for you. In fact, you might not really know what it means to refinance your mortgage or why someone would want to refinance at all.

Well, you’re in the right place! First things first: people generally refinance to save money. Depending on your situation, refinancing your mortgage can help you reduce your monthly payments, lower your interest rate, or give you access to home equity. If you’re paying for private mortgage insurance (PMI), refinancing may offer a way to eliminate that cost. Or refinancing may allow you to switch from an adjustable-rate to a fixed-rate mortgage.

Refinancing your mortgage is a smart choice for some people. For others, the timing may not be right or you may already have the best mortgage for your financial situation. Here, we’ll walk you through some of the considerations that will help you decide if refinancing is right for you.

Refinancing 101

You may have heard of refinancing your mortgage, but you might not really know what it means. There’s no shame in not knowing — you’re not alone! Let’s start with the basics.

When most people buy a home, they make a cash down payment (often 20% of the total home price, although it may be more or less in certain situations). They pay for the rest with a bank loan, called a mortgage. Refinancing your mortgage simply means getting a new mortgage to replace your current mortgage.

- Refinancing your mortgage: Refinancing is the process of changing out your existing mortgage for a new one.

Refinancing is a lot like the process of getting a mortgage to purchase a home. You’ll need to apply, go through an underwriting process, and there will be fees and closing costs associated with the new mortgage (we’ll come back to those costs later).

OK, so refinancing is basically taking out a new mortgage in place of your existing mortgage. Why would someone want to do that? We’re glad you asked!

Reasons to refinance

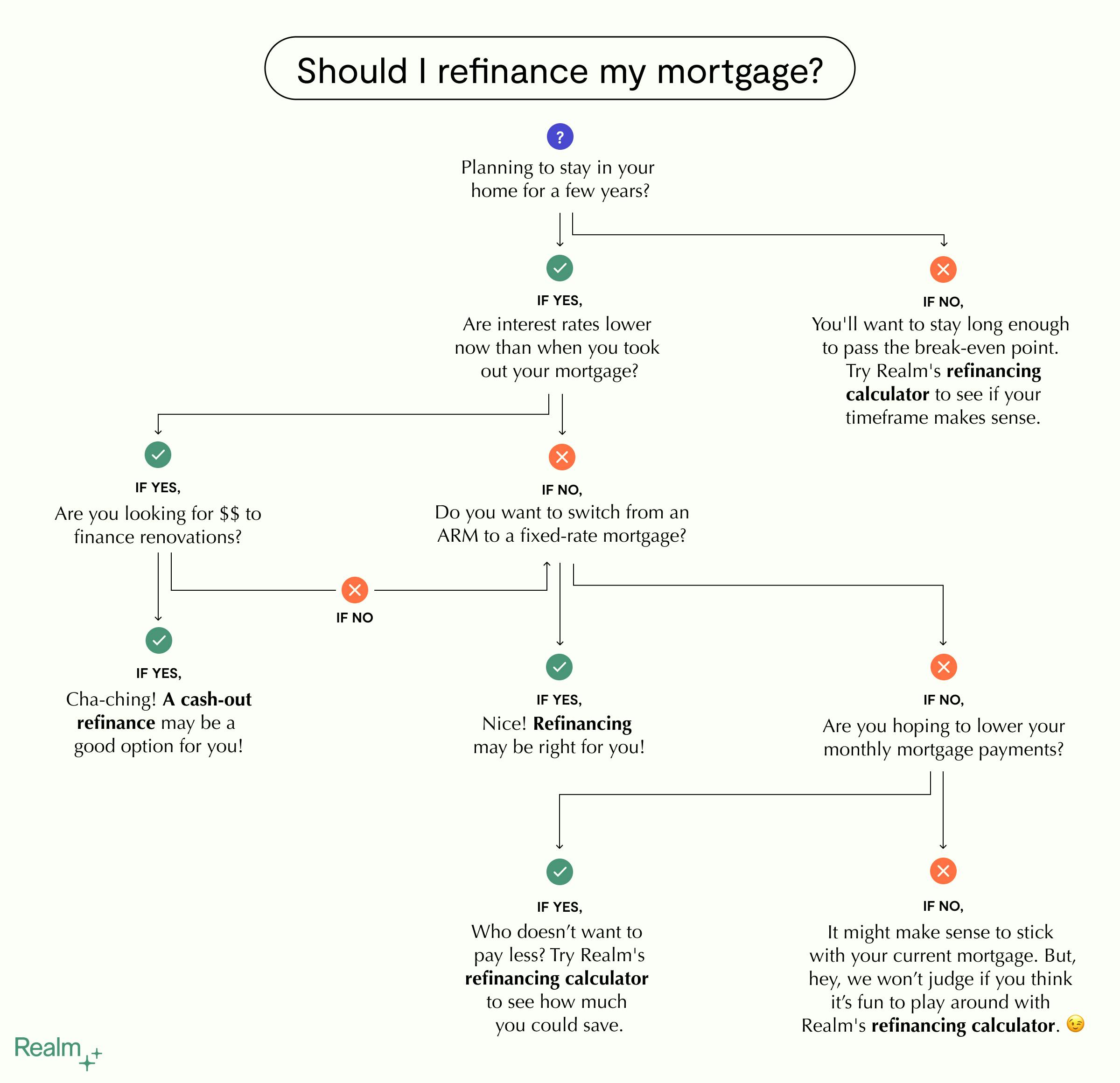

There are many reasons why someone might opt to refinance their mortgage. It’s a very personal decision and depends on your current financial situation, your plans for the future, and your goals. With that in mind, here are some of the reasons people might choose to refinance:

- Lower monthly payments: You’ve probably heard that mortgage rates have been at record lows. Even with small fluctuations up and down, current rates are lower than they’ve been in decades past. If you bought your home several years ago when rates were higher, refinancing could be an opportunity to lower your interest rates, which would lower your monthly payment. You may also be in the market for a better interest rate if your credit score has improved since purchasing your home. You can check out current refinance rates from a variety of lenders here.

- Switch from a 15-year to a 30-year loan: Maybe you’re refinancing to change the length of your loan term. Perhaps you want to pay your mortgage off more quickly. Refinancing from a 30-year to a 15-year loan would allow you to do that — but keep in mind that would probably increase your monthly mortgage payments. If you’re looking to extend your mortgage term, you may be able to lower your monthly payment — although you will likely pay more interest over the life of the loan.

- Replace an adjustable-rate mortgage with a fixed-rate mortgage: If you got an adjustable-rate mortgage (ARM) when you bought your home, you will eventually face interest rate fluctuations when the loan’s fixed period ends. Converting your ARM to a fixed-rate mortgage when you refinance can provide more stability and predictability in your monthly payments.

- Eliminate private mortgage insurance: Private mortgage insurance (PMI) is usually required if you put down less than 20% when you buy your home. PMI can add a significant amount to your monthly mortgage payments — but there are ways to get rid of this extra cost. Refinancing is one route to eliminate your PMI. When you refinance, if your new mortgage balance is less than 80% of your home’s current value, you should be able to say goodbye to that PMI. (Keep in mind that FHA mortgage insurance has a special set of rules and guidelines.)

- Use your equity to access cash: If you’ve built up equity in your home, either through your monthly mortgage payments or because your home’s value has increased (or both), you can refinance and borrow a larger amount than your existing mortgage balance, taking the excess in cash. This is called a cash-out refinance and you can use that money however you wish — to finance home renovations, pay for a child’s college education, or invest in your own retirement. Regardless of how you choose to use the money, keep in mind that you’ll be paying interest on that cash (your refinanced mortgage interest rate). Check out your free Realm dashboard to get an accurate estimate of the funds you could access through a cash-out refinance.

See how much equity you've built

Refinancing considerations

While there are plenty of good reasons to refinance your mortgage, there are some important caveats and considerations when evaluating whether it’s the right option for you.

When you refinance, you’re getting a new mortgage — and that comes with its own expenses. In general, you should plan to pay about 2% to 6% of the total loan amount in closing costs and fees. It’s very important to factor this amount into your refinancing calculations because they help determine something called the break-even point.

- Break-even point: The amount of time it will take to recoup the cost of refinancing and start benefiting from the savings of your refinance.

It only makes sense to refinance if you’re going to stay in your home long enough to pass the break-even point and get the chance to reap the rewards of refinancing. So how long does it take to break-even? Our refinancing calculator takes costs and fees into consideration, but here’s one way to think about it:

Break-even point = Total loan costs / monthly savings

For example, if the total cost of refinancing is $5,000 and you’ll save $200 each month with your refinanced mortgage, this is how long it would take to recover the cost of the refinance:

Break-even point = $5,000 / $200 = 25 months (or just over 2 years)

Is refinancing right for you?

Just like buying a home, deciding to refinance your mortgage is a big decision. It’s important to take a close and honest look at your financial situation while weighing the pros and cons of your refinancing options.

The Realm dashboard is free-to-use and has simple tools that will help you better understand your home finances. You can enter your existing mortgage details to see how much equity you’ve built in your home, as well as any recent changes to your equity. You can also easily see your potential savings from refinancing.

If you’re thinking about a cash-out refinance to fund home renovations, your dashboard will provide an estimate of the funds that may be available to you. While you’re on the Realm dashboard, you can also explore potential renovations and get accurate pricing for dozens of projects, all based on your location. Plus, you can see how much each project would add to your home’s value — further increasing your equity in your home.

Regardless of what choice you make, it’s good to understand what it takes to refinance your mortgage. Your financial situation changes month by month and year by year. So even if it’s not the right option for you at the moment, it could be in the future.

Frequently asked questions

What is the formula for refinancing?

There are many factors that go into figuring out whether a refinance is right for your financial situation. The Realm refinancing calculator considers your existing mortgage terms (origination date, length, and interest rate), and your outstanding loan amount, as well as your new loan amount and new interest rate. When you use the calculator, you can see how adjusting any of these factors changes your monthly payments as well as your break-even point.

Is it worth refinancing to save $200 a month?

That all depends on your current monthly payments and your overall financial picture, including how long you plan to stay in your home. For some people, saving $200 a month may be plenty of reason to refinance. For others, it wouldn’t be worth it. The best way to determine if it’s the right choice for you is to be honest about your financial needs and goals. Then, you can use the Realm refinancing calculator to see if a refinance will help you achieve those things.

What are today’s refinance rates?

Refinance rates fluctuate daily and vary based on your outstanding loan amount, your location, the loan term you’re seeking, and your current credit score. Realm has current rates from a range of lenders. On your dashboard, you can also get an accurate estimate for cash-out refinance rates. It’s also a good idea to speak to a qualified lender to get rate details specific to your situation.

How much are closing costs on a refinance?

This is a crucial question when considering a refinance. Typically, you should expect closing costs and fees to be anywhere from 2% to 6% of the total loan amount.

Is refinancing worth it for 5 years?

It all depends on the terms of your refinance, particularly whether you’ll hit the break-even point in that time frame and how much you will save once you have crossed that threshold. Using a refinancing calculator will give you a clear picture of what your savings will look like in five years so that you can decide if a refinance makes sense for you.

Published by Realm

Get more out of your biggest asset: your home. Realm shows you what your home could be worth & how to access more of its potential value. View more posts