Finding a home that fits your budget

What you’ll learn:

- How to estimate your monthly mortgage payment

- Which factors impact your monthly payment

- What the DTI ratio is and why it matters when buying a home

- How to lower your monthly payments

- How Realm can help you estimate your monthly payments

Whether you’re dreaming about buying your first home, thinking about selling your current home to downsize or upgrade, or simply exploring your options as a homeowner, there’s probably one thing that’s top of mind: money.

You’ve undoubtedly heard that it’s important to buy a home within your budget. But with mortgage payments, interest rates, and insurance, knowing just what that number is may seem daunting. And even if you know how much you can spend on a home in total, it can be hard to estimate what your monthly mortgage payments will look like.

While the cost of a home may seem staggering at first, it shouldn’t keep you from believing you can find a home in your price range. Before you start house hunting, it’s essential to establish a realistic budget. Here, we’ll help you understand why your monthly housing budget is important, what factors impact how much you pay each month, and how Realm can make home budgeting a simple and straightforward endeavor.

Estimating your monthly mortgage payment

Buying a home is exciting, but it’s also important to have a clear sense of how you’ll pay for your property. To purchase your home, you’ll likely take out a mortgage from a lender. Therefore, estimating how much you’ll owe in monthly mortgage payments is a crucial first step in finding a home that fits your budget.

Realm’s mortgage calculator gives you an accurate estimate of how much your monthly mortgage payment will be and allows you to change variables such as interest rates and insurance to explore what’s possible for your financial situation.

To correctly estimate your monthly mortgage payments, you’ll need to understand your overall home budget. Most people will take out 30-year mortgages when buying a home, though 15-year and 20-year mortgages are also common. Generally speaking, the longer the mortgage term, the lower your monthly mortgage payments. However, with a longer mortgage term, you will pay more in interest over the life of the loan. (The reverse is also true: a shorter mortgage term will have higher monthly payments, but you’ll pay less interest over the full life of the loan.)

Regardless of your mortgage terms, when searching for a home, you want to establish a clear price range that you can afford. Knowing roughly how much you can spend starts with a clear examination of your finances.

- Begin by assessing your income. This should include all of your revenue, from salary to investments.

- Then consider your debt, including what you’re currently paying either in rent or an existing mortgage, as well as your monthly spending for other loans, such as student debt or car payments.

- In addition to your recurring monthly debts, you should also list out your monthly expenses to see where you could cut back.

- Finally, check your credit score, as this will impact the loan terms that lenders will offer.

Want to learn more about setting your home price budget? Click here to dive deeper and to use Realm’s free home affordability calculator.

You should also take a complete and honest look at your savings to decide how much you feel comfortable putting towards a down payment. The greater your down payment, the less you’ll pay in monthly mortgage payments — but you also don’t want to deplete the entirety of your savings, leaving you with no cushion for any unexpected costs that may arise in the future (including home maintenance costs). A standard rule of thumb is to always have at least three months of mortgage payments in savings.

What factors go into your monthly mortgage payments?

A home’s sale price isn’t the only factor that impacts your monthly payments. Learning the components that go into a mortgage payment will give you a better sense of what you can afford. The main components include:

- Principal: This is the overall loan amount that you borrow when you take out your mortgage. Generally, when you buy your home, the principal is the cost of the home (including closing costs) minus your down payment.

- Down payment: The amount you pay up front towards the total cost of the house. Depending on your financial situation and the type of loan you get, this could be anywhere from 3% to 20% of the total home price.

- Interest rate: This is the fee you pay for borrowing money to purchase your home — in other words, a fee on your mortgage. It’s charged by your lender (this is how they make money) and is calculated as a percentage of your outstanding principal. Currently, interest rates are still historically low. Interest rates can vary significantly from lender to lender, so it’s worth shopping around, as even an eighth or quarter percentage point can mean a considerable difference in cost over the life of a 30-year mortgage.

- Insurance: In almost all locations, unless you are buying your home outright (and not getting a mortgage), homeowners are required to have insurance to cover the property. The cost of insurance can change annually and is factored into your monthly payments by most lenders.

- Property taxes: This is the annual amount you pay your local government in taxes for owning the property. Your local assessor determines the value of your house, which is then used to calculate your payment based on local tax rates (often referred to as millage rates).

- HOA Fees: If your home is part of a Homeowners Association (HOA), you may also have to pay HOA fees. These fees can vary greatly depending on the amenities they’re intended to cover — which could include everything from landscaping public grounds in your neighborhood to maintaining a shared community pool. When house hunting, it’s important to find out whether a home is part of an HOA and ask for estimates of those fees.

When you use Realm’s mortgage calculator, you can easily see how each of these factors impact your mortgage payments. By adjusting any of these costs, you can quickly get a good idea of which factors will have the greatest impact on your monthly budget.

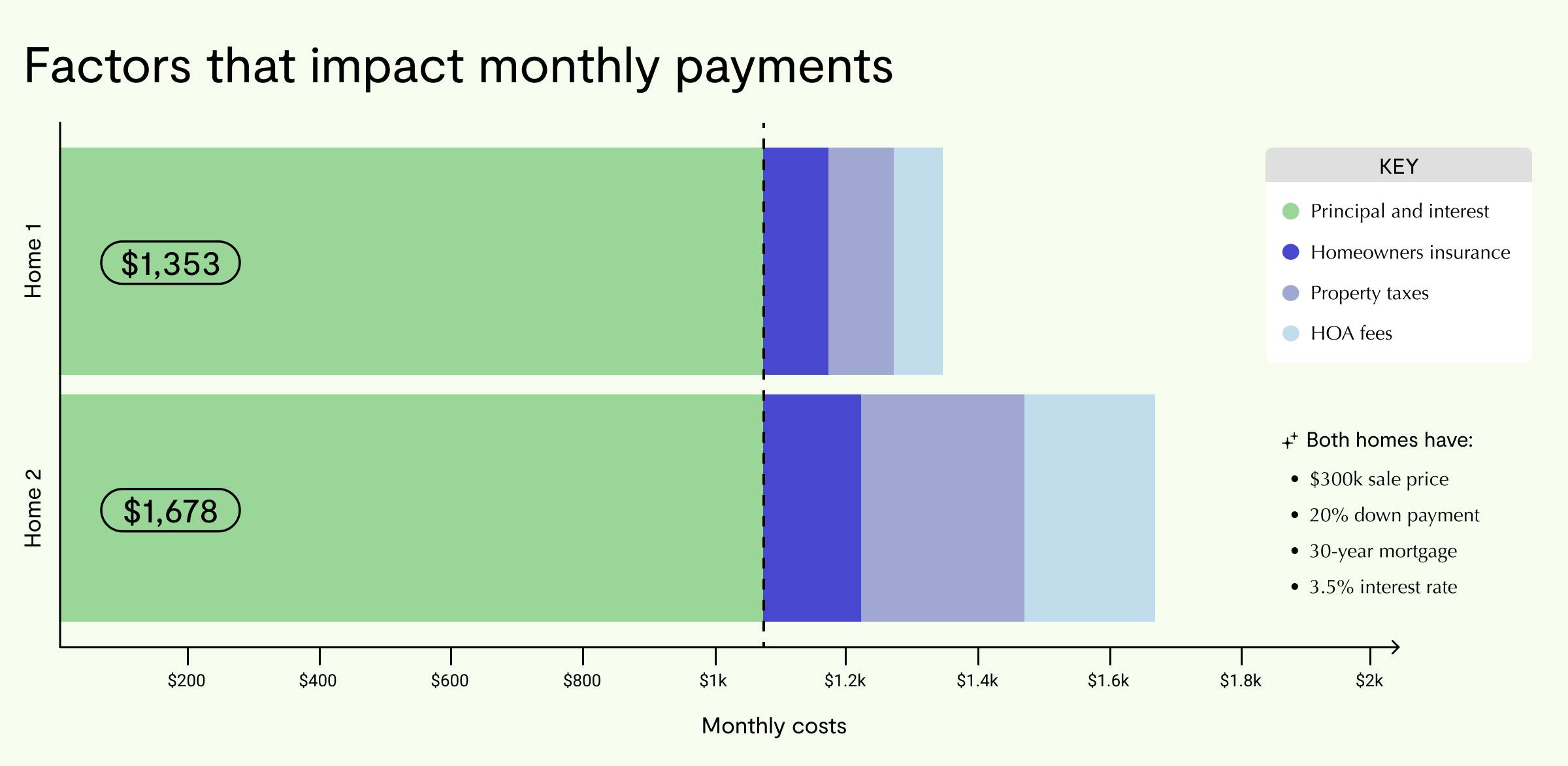

For example, let’s say you’re looking at two similar homes in neighboring counties. The homes are the same price and you’d make a 20% down payment on both. Plus, you’d get the same mortgage terms and interest rate on either home. But, there are some other key differences that could make a big impact on your monthly payments. Here’s how your things could look:

It’s important to keep in mind that even when including all these factors in your monthly payment, these aren’t the only costs associated with homeownership. Closing costs and inspection fees will add to the purchase price. And once you buy your home, you also need to account for maintenance costs, so if your oven dies or your roof has a leak, you have enough in reserves to pay for fixes.

Explore your home's hidden potential

What is the DTI ratio and why does it matter?

While it’s important for you to have a clear sense of your housing budget, you’re not the only one keeping an eye on your finances. Any lender will want to make sure that you’re going to have no trouble reliably making your monthly mortgage payments. Debt-to-income ratio, or DTI, is one way lenders assess your financial situation and determine how much they’re willing to lend you. DTI is the percentage of your total monthly income that goes toward paying debts.

Debt-to-income ratio = debt / pre-tax monthly income

The general rule of thumb from financial experts and most lenders is that a homeowner’s DTI should follow the 28% rule. That means that your total monthly housing payments should not exceed 28% of your monthly pre-tax income.

For instance, let’s say you make $60,000 a year. That’s $5,000 a month before taxes. So what’s the most you would want to spend on housing each month if you stick to a 28% DTI or lower?

DTI = X monthly housing debt / $5,000 = 28%

To figure out X, you multiply $5,000 by .28, which equals $1,400. (Thanks, algebra class!)

DTI = $1,400 / $5,000 = 28%

Lenders also advise that your total monthly debt payments (not just including housing) should be no more than 36%. Together with the DTI guidance for housing costs this is known as the 28/36 rule.

Let’s use the same example. Say you make $60,000, or $5,000 a month, and you make monthly debt payments of $600 toward student loans and car payments. Along with your $1,400 in housing payments, that would put your total monthly debts at $2,000. Would you still be under 36% DTI? Let’s see:

DTI = $2,000 / $5,000 = 40%

Nope, you’d be over. To stay under 36%, you’d need to knock off $200 in monthly debt payments.

DTI = $1,800 / $5,000 = 36%

If you already have many outstanding debts, your DTI may be high before even considering a mortgage. And the higher your DTI, the more difficult it may be for you to get a loan. Therefore, keep DTI in mind when calculating your home affordability budget and look for ways to reduce or eliminate any existing debt if you’d like to spend more on a home.

What are some ways to lower my monthly payments?

There are a number of variables that go into the cost of your monthly mortgage payments. Adjusting any of these factors can help you lower your overall monthly payments — sometimes by a significant amount. Using the Realm mortgage calculator is an easy way to play around with the different variables to see how your monthly payments might change.

One of the biggest factors in the overall cost of your mortgage is the interest rate on your loan. The lower your interest rate, the less you will pay monthly and over the life of the loan. There are a variety of mortgages available, but two of the most common are fixed-rate and adjustable-rate. Fixed-rate mortgages lock in a rate for the life of the loan. That is especially wise to do when interest rates are relatively low, as they are now, as they will likely rise in the future. Adjustable-rate loans are just that — adjustable. They will fluctuate over time depending on many factors, including the overall health of the economy, federal interest rates, and the demand for loans. This can be positive if rates drop in the future, but you also run the risk of significant increases to your interest rates — and your monthly payments — if interest rates rise.

Additionally, the length of the loan will impact your monthly payments. Shorter loans, such as 15-year and 20-year mortgages, will allow you to pay off your mortgage debt more quickly and reduce the total amount of interest paid over the full life of the loan. But paying your debt off more quickly also means that your monthly payments will be higher.

Your down payment also dramatically affects your monthly payment. As you might have guessed, the more you pay up front, the smaller the mortgage principal — which translates into a smaller monthly payment. Traditionally, lenders have sought a down payment that’s 20% of the home’s purchase price. If you can afford this, it’s generally a wise move to go with this type of conventional loan. But if you have less in cash savings to put toward a down payment, there are different types of loans that allow buyers flexibility and require smaller down payments.

- An FHA loan is secured by the Federal Housing Administration rather than a private lender, like a bank or mortgage company. With an FHA loan, your down payment can be as small as 3.5% of the value of the home. For first-time buyers, and those with limited savings, this can be a viable and attractive option. To qualify, you must have a credit score above 580. Keep in mind that when you get an FHA loan, you will also be required to get private mortgage insurance, which will add to your monthly payments.

- VA loans are available for those with a military connection. These loans are backed by the U.S. Department of Veterans Affairs, but issued by a private lender, like a bank or credit union. If you qualify for this type of loan, you can purchase a home with no down payment because the loan is guaranteed by the VA. To be eligible for a VA loan, you must be active duty or retired military personnel, or in some cases, the surviving spouse of a person who served in the military. VA loans do not require private mortgage insurance.

If you already own a home and are looking to lower your monthly payments, you may be considering refinancing your mortgage, especially if interest rates have gone down since you bought your home. Click here to learn more about whether refinancing might be right for you.

How can Realm help you estimate your monthly payments?

Realm’s mortgage calculator provides valuable insights about your monthly mortgage payments. You can test out various scenarios, like different home prices, interest rates, and mortgage terms, to see how your monthly payments will increase and decrease as you change these factors.

If you’re house hunting and looking for ways to lower your monthly payments, you might want to flip your thinking: instead of saving up more to buy an expensive home and struggling to make your monthly payments, buy a home with potential, so you can invest in it slowly over time. Let’s say you find an affordable home that ticks some of your boxes. Even if the home needs upgrades or renovations, you can put less money down, borrow less, and spend less on interest. Over time, as you build equity by making your monthly payments, you can tap into that equity to finance your home improvements. It’s a win-win!

Realm’s free dashboard is a great way to see how much value you could add to a potential home with projects and renovations. If you find a promising home, just add the property to your dashboard. Then, you can easily see how much the home could be worth with upgrades and renovations, and you get accurate cost estimates for a huge range of projects, from home additions to landscaping. Using Realm will show you what’s possible for any potential new home.

Frequently asked questions

How much income do I need for a 400K mortgage?

Mortgage costs vary greatly based on your down payment, the length of the mortgage, local property taxes, and your interest rate (which is based in part on your credit rate and your debt). Using Realm’s mortgage calculator, a $400,000 home with a 20% down payment, a 30-year mortgage, and a 3.2% interest rate, your monthly payment will be $1,384, without factoring in insurance and taxes. If you’re using the 28% rule for DTI, that would mean you’d need to have a monthly income of about $4,945 before taxes — or a salary of about $60,000. And remember, that’s before factoring in insurance, taxes, and any possible HOA fees.

How much does a mortgage payment increase for every $10,000?

Based on Realm’s mortgage calculator, with a 3.2% interest rate and a 20% down payment, your monthly payment will generally increase by around $35-40 per month for every $10,000 increase in the cost of the house.

How much house can I afford on a $80K salary?

What you can afford to pay for a house will depend not just on your salary but also on your debt level. Using that 28% DTI rule, with an $80,000 salary, your monthly pre-tax income is about $6,667. When you take 28% of your monthly income, you get $1,867 — that should be the cap on your monthly housing costs, including taxes, insurance, and any other fees.

How much income do you need for a $800,000 home?

Because mortgage costs vary based on a number of factors, the best way to estimate your monthly payments is to use the Realm mortgage calculator. When you put in a $800,000 home price with a 20% down payment, a 30-year mortgage, and a 3.2% interest rate, you can see that your monthly payments will be $2,768. That’s without insurance and taxes. If you consider the 28% DTI rule, that would mean you’d need to make about $118,630 annually — just to cover the principal and interest. When you factor in insurance and taxes, you’d need to make more.

Can I buy a house if I make $45,000 a year?

Yes, though, your ability to afford a house with a $45,000 income level will depend on your credit history and how much other debt you carry, among other factors. The general rule of thumb is to spend no more than 28% of your income on housing, which would put your monthly payments, including insurance and taxes, at a max of $1050. Many markets have at least some homes available within this price range.