How much is your home really worth?

What you’ll learn:

- What home value is and how it’s calculated

- Why home value matters

- Factors that impact your home value

- How you can increase your home’s value

When many people think about buying a home, they often imagine the space, the design — how they want to live. But as soon as you begin the process of house hunting, it becomes clear that homeownership is also a financial endeavor. This starts during the purchase process, from assessing how much house you can afford to choosing the right mortgage for your needs, and continues well past your closing date. Why? Because a home isn’t just a place to live. It’s also a huge financial investment. In fact, for most Americans, their home makes up 62% of their total assets.

One of the most important things to understand about your home is how much it’s worth — and how that value changes over time. But if you’re like many other homeowners, home value may seem like a bit of a mystery. If this is the case, don’t worry! Home value is a complicated subject and even longtime homeowners often don’t fully understand all that goes into calculating the true worth of a home.

Here, we’ll look at what factors contribute to your home valuation, what you can do to boost its value, and how Realm can help you tap into your home’s hidden potential.

What is home value?

There’s an old adage when it comes to measuring your home value: Your home is worth whatever someone else is willing to pay for it.

This is true — but only to an extent. The real challenge is predicting what someone might pay for your home. There are a whole slew of factors that contribute to your home’s value and they can change over time. Not to mention that each home is unique, which makes it tough to accurately estimate how much someone might be willing to pay for it. Imagine two homes on the same block, right next door to each other. One may have four bedrooms, the other only three. One might have recent renovations, while the other is a time capsule from the 1970s. One may have a beautifully landscaped backyard, while the other is an overgrown mess. All these factors (and many, many more) impact home value. Which means that in reality, figuring out the actual worth of your home is a bit more complex.

So how does anyone figure out home value? In general, there are three ways to measure it:

- Fair market value: The value of your home if you were to try to sell it in an open market.

- Appraised value: The value of your home based on an assessment by a professional appraiser, which is used by mortgage lenders during the underwriting process when determining how much you can afford to borrow.

- Assessed value: The value of your home based on a valuation set by your municipal, local, or county tax assessor. This valuation is used to determine how much you’ll pay in property taxes and is often lower than the fair market value.

Understanding these different valuation types will help you to understand that the value of your home will likely differ depending on whether it is being assessed by a lender, a real estate agent, a privately hired appraiser, or your municipal tax appraiser.

For instance, many tax appraisers use a triangulation or sales comparison (or comparative market analysis) approach to estimate home value. This means they compare your home to similar homes nearby that have recently been listed or sold and use those valuations to estimate yours. When you’re getting a home valuation from an appraiser, you can ask for a confidence score that will help indicate the estimate’s accuracy. For instance, a confidence score of 70% means that the prediction is within 30% chance of market value—which is a lot of fluctuation for you to consider.

Other home valuation methods can be used as well, such as the cost approach, which is more relevant for new or recently renovated homes. With this method, your home value is largely determined by the cost of materials used to construct or renovate the house, along with the price of the property.

It’s important to remember, however, that there is no single, perfect way to get an estimate of your home’s value that will be 100% accurate in every case. No matter how the value is estimated, or who is doing the estimation, it is just that — an estimate. Professional appraisers can provide more objective valuations, but even they cannot know for sure what your home is worth or what it will sell for. Additionally, sometimes, real estate agents will list homes below market rates to entice a flurry of offers from potential buyers. In other cases, they’ll do the opposite, and list it above market value, especially in desirable markets, to see if they can max out what a potential buyer is willing to pay.

Also keep in mind that whoever is performing your home valuation will do so from a unique perspective with some biases built in. A real estate agent’s pay is generally based on commission, so they may try to overinflate your home’s value to help their own bottom line. Compare that to the motivations of a bank or lender, where your ability to repay the loan is one of the most important factors when determining how much they’re willing to lend you. Depending on your financial situation, a lender may lean toward a more conservative estimation of your home’s value, meaning the cost of the home would be lower and your ability to pay your mortgage would be more certain.

There is, however, one method that reduces these subjective motivations and biases — an automated valuation model, or AVM. Like the sales comparison approach, an AVM relies on sales and listings in your area to arrive at an estimate. The benefit of an AVM is that it takes personal incentives out of the equation because AVMs rely on aggregating large volumes of data. The more data that’s available, the more accurate the AVM. Realm uses an AVM to provide accurate, up-to-date home valuations based on about 600 data points per property — which is what makes our home value estimates so reliable.

Find out your home's value

Why does home value matter?

Your home’s value matters not just when you want to sell, but also if you want to refinance your mortgage or borrow against your equity — whether to finance a home improvement project or to access funds for large expenses (like paying for college). When it comes to refinancing, particularly using your home’s equity as a credit line, it’s important to know that the value of your house isn’t fixed. It can and will change over time — for better or worse. Because of these fluctuations, there are certain risks when borrowing against your home’s value, though in many instances, these are risks worth taking when the loan can actually increase the value of your house long-term.

The bottom line is that knowing your home’s worth is crucial to making informed financial decisions and engaging in smart financial planning. Estimates of your home’s worth can give you a good idea of an asking price if you want to sell or help you understand how much you can comfortably borrow with a home equity loan.

- Realm tip: Getting a clear picture of your home’s value can also help you assess whether you need to make renovations to tap into the full potential of your property. Your Realm dashboard is a great place to explore your home’s current value and the potential value you could add with different projects.

What factors impact how much your home is worth?

Over the course of U.S. history, homes have generally been relatively safe investments that increase in value over time. Compare this to a new car, for instance, which immediately depreciates in value once you drive it off the lot, and it’s understandable why so many people view their homes as a secure way to invest their hard-earned money. But understanding the factors that go into tallying your home’s value will give you a better idea of what could impact that value (either positively or negatively) in the long-run.

One of the main reasons homes typically increase over time has to do with simple supply and demand. When demand outstrips supply, home prices increase. There are several factors that may constrain home inventory:

- Limited land available for development.

- The high cost of new construction.

- Local policies and regulations that prevent new construction, especially high density housing, such as apartments.

When there’s limited supply and increased demand for homes in your area (or in general across the country), that usually means the value of your home will rise.

But when it comes to your home in particular, there are other, more specific factors that contribute significantly to its value.

Characteristics of the area

- Location, location, location: Obviously, where you live is one of the most important factors contributing to your home’s overall value. If you live in a desirable location, or an especially hot real estate market (such as San Francisco or New York), your home will command more than it would in a place where fewer people want to live or move. Your neighborhood also matters, including whether you live near quality local public schools or amenities like public transportation, restaurants, and shopping districts.

- Safety: We all like to feel secure in our homes, so a house in a high-crime area can have a lower value than homes in places with less crime. Additionally, living in places particularly prone to natural disasters, such as floods or hurricanes, can also negatively impact the value of your home.

- Taxation: Often, some of the most in-demand areas also have higher property taxes (which is part of the reason these areas are desirable in the first place, as higher taxes help municipalities support quality schools, infrastructure, and economic development). But in some cases, high tax rates can also depress the value of your home, while areas or states with lower property taxes (such as Colorado) can make your home more enticing to potential buyers.

- What similar properties have sold for: If comparable properties in your area have sold for competitive prices, this will also help increase your home’s value.

Characteristics of the home

- Past resale value: This is more relevant if your home recently sold than if you’ve owned it for years, but past sales give an indication of the demand for your home.

- The quality of your home: As you probably could’ve guessed, your home’s details really matter! The construction quality, the design and layout, the materials and finishes, and the overall condition of your home have a big impact on its value. A crumbling facade will lower the value, both in terms of resale and appraisals.

- The home’s size: Is your home a modest, single-story ranch with two bedrooms and 1.5 baths? Or is it a four-bed, three-bath with a finished attic? When it comes to your home value, square footage matters.

- The home’s amenities: Brand new appliances, a deep soaking tub in the primary bath suite, a beautifully landscaped yard, or even a backyard accessory dwelling unit. These amenities also make a difference when it comes to your home’s value.

There’s one other powerful factor that impacts how much your home is worth: the overall strength of the economy. When people have more money, they’re more willing to spend it, meaning your home value will likely increase. A strong economy can increase your home value, while a recession, even if it’s not directly tied to real estate, can lower it. Additionally, when mortgage rates are lower, potential buyers can afford to spend more on the property itself, and these rates are greatly affected by the overall health of the economy.

- Realm tip: If you’re thinking about selling your home and want to amp up its value, home renovations can make a big impact, especially if you choose the right projects. You can explore potential upgrades and renovations on your free Realm dashboard, which will show you how much these projects will cost in your area and how much value they’ll add to your home.

How much value could renovations add to your home?

How can you increase the value of your home?

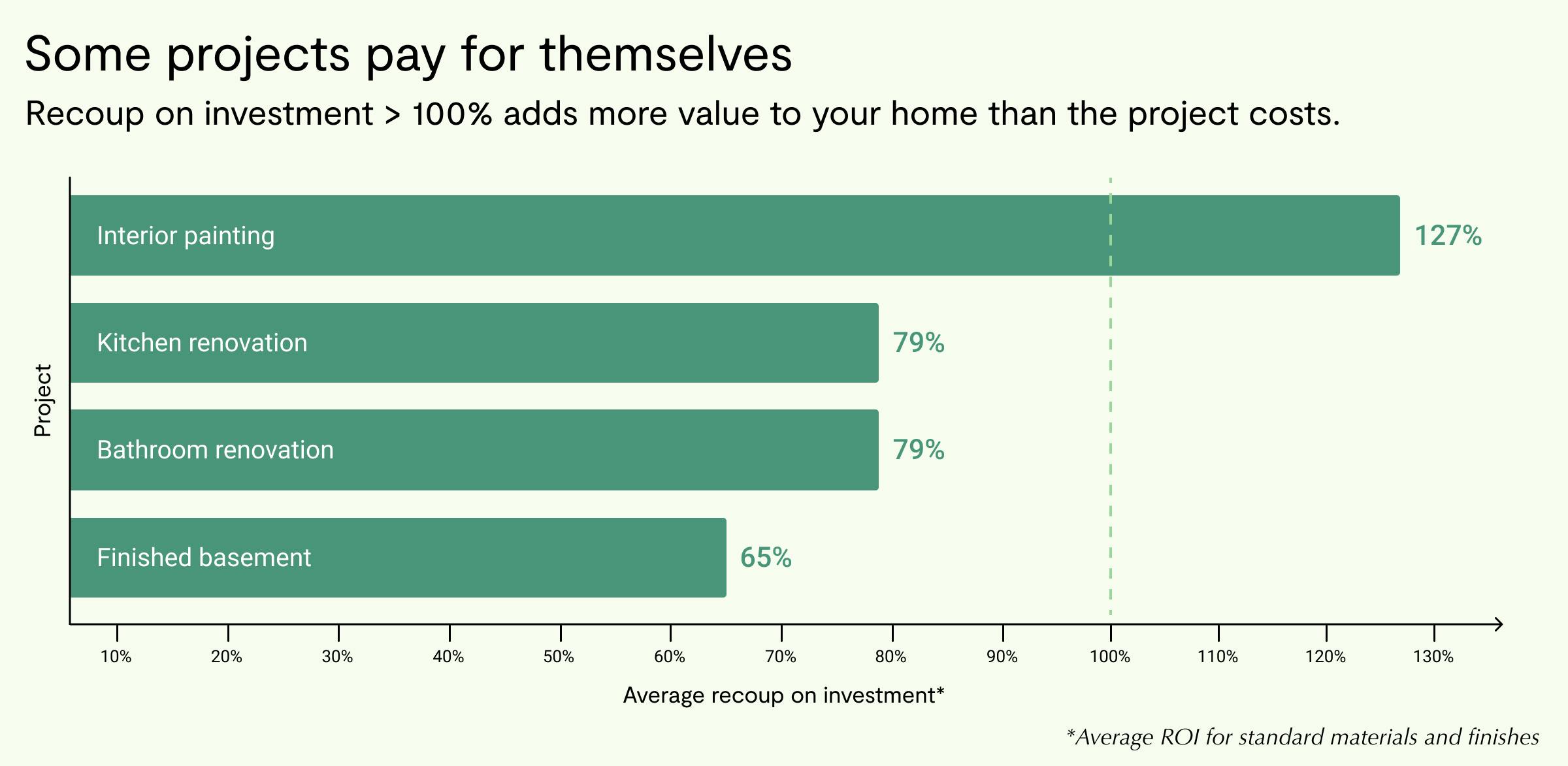

Once you understand your home’s current value, you may be wondering, how can I increase it? There are a number of ways to achieve this goal — and they all start with your willingness to renovate. Though the cost of home improvements can sometimes seem daunting, if you plan properly, the long-term return on investment is often worth the upfront expense. Even if you have a limited budget, there are ways to increase your home’s value:

- Enhance your curb appeal: First impressions matter in life and especially in home valuations. There are a number of ways to make your house more attractive that won’t break the bank, such as spending money on quality landscaping, repainting the exterior, and fixing broken siding or cracked foundations. In fact, the average investment recoup for a driveway replacement is 252%, while exterior painting has an average recoup of 129%. That’s a lot of bang for your buck!

- Update the style: If your house is more than 10 years old, the style and features may feel dated. Kitchen and bathroom renovations often go a long way in making a house feel modern and appealing to potential buyers. Also keep in mind that although every buyer will value aspects of a house differently, making your house too unique can make it harder to sell later. When planning renovations, factor in widely accepted trends, such as open kitchens and living areas, and walk-in showers. Appraisers consider renovations when making their estimates, so your work will pay off.

- Invest in new appliances: If you don’t have the money for a complete kitchen renovation, you could also add value with new appliances, such as refrigerators, dishwashers, or washers and dryers. These are often less expensive than you think and can help increase both the curb appeal and elegance of your home.

- Make it more energy efficient: The cost of home solar power continues to go down and states and municipalities often have tax rebates for installing solar panels. Solar can be attractive to potential buyers, as it means lower energy costs over time. If you can’t afford solar panels, you can also make your home more energy efficient by replacing old or broken windows, installing insulation, upgrading outdated AC and hot water units, and weather-proofing doors and windows.

- Expand your space: A near surefire way to increase your home’s value is to increase its size. If you’re open to adding bedrooms or bathrooms, or an outdoor space, such as an accessory dwelling unit (ADU) or even a patio, this can boost your home’s overall value.

Fix what needs fixing: If you’re preparing to sell, don’t plan on being able to hide your home’s problems from potential buyers. This is especially true for items that can make your home feel like it’s in need of maintenance, such as a dilapidated roof or an old water heater. Home assessments will turn-up problems that you’ll have to pay for during the sale process, and it’s better (and usually cheaper) for you to address them before buyers get involved.

Ultimately, it’s good to know that you have a lot more control of your home’s value than you might think. While you obviously can’t change your home’s location, home improvement projects can greatly help to increase your home’s value. If you’re not sure what type of project would have the greatest return on investment for your specific property, you can explore your options with the Realm project planner. The planner lets you customize projects to get accurate cost estimates and easily see how much each project would add to your home’s value.

How Realm makes home valuation easy

When you log into your free Realm dashboard, you get an accurate, reliable home valuation based on unbiased data about your property. If you or a prior owner made upgrades or renovations, you can edit your home details and get an updated and even more accurate home valuation. But Realm does more than provide your home’s current value. The dashboard also shows you how much your home could be worth — and which projects will help you tap into your home’s value potential. Get started today to see how much your home could really be worth.

Frequently asked questions

How do I calculate the value of my house?

One of the best ways to figure out your home’s value is to use Realm’s free online dashboard. You’ll get an accurate estimate specific to your property. You can also work with a realtor to find the fair market value or work with an appraiser to get an estimate based on comparable sales and listing data.

Why is knowing your home value important?

For most people, your home is your largest investment. Knowing the value of your home isn’t just important if you plan to sell it. Home value also factors into how much you can borrow if you plan to draw on your equity or open a line of credit, or if you plan to refinance, as well as your overall financial wellbeing.

What is it called when they tell you how much your house is actually worth?

Generally, this is called fair market value, which is a fairly reliable estimate of how much your home would sell for on the open market.

How do I find the actual value of your home?

The actual value of your home is however much someone else is willing to pay for it. But you can get a good estimate of its value by using tools like Realm’s free dashboard, or working with a realtor or appraiser.

What is the most accurate site for home values?

The accuracy of home valuation sites varies greatly and it’s important to work with one with reliable data and results, such as Realm.

Published by Realm

Get more out of your biggest asset: your home. Realm shows you what your home could be worth & how to access more of its potential value. View more posts