How to pay for your renovations

What you’ll learn:

- What home equity is and how to use it

- Home equity financing options

- Government loan options

- Alternatives to equity financing

- How to choose the right financing option

Home renovations involve so many decisions, it can be easy to overlook one of the most important: how to pay for them. Yet figuring out the financing from the get-go is essential.

Fortunately, banks and other lenders have created multiple financing tools to allow you to fund these repairs and upgrades, including by leveraging your home's equity.

An easy way to think about home equity is that it’s the portion of your home that you actually own. You gain equity in a few ways. Your initial down payment is your first piece of equity and then you build more equity each month with your mortgage payments (specifically, the amount that goes toward your loan principal). You also gain equity as your home’s value increases over time. With certain renovation financing options, you can use that equity as a borrowing tool in the form of collateral.

What if you don't have enough equity or don’t want to use your home as collateral? More good news: There’s likely at least one solution for any situation — even if you have less-than-stellar credit.

In this general overview, you'll learn about the different financing tools, their potential pros and cons, and when each option might make the most sense. Keep in mind: all of these options are complex and deciding to use any one of them would require a deeper dive to truly understand if it’s the right choice for your situation.

Before you get started, you'll want to understand some key terms:

- Home equity: The current market value of your home less the mortgage owed.

- Secured vs. unsecured loans: Secured loans are backed by collateral (e.g., your home or car) as opposed to unsecured loans, which aren't.

- Debt-to-income ratio (DTI): The percentage of your income that goes toward paying down debt, such as your mortgage, car loan, or student loans. When it comes to borrowing money, the lower your DTI ratio, the better.

- Loan-to-value ratio (LTV): Your outstanding mortgage amount divided by the value of your home. For example, if you owe $300,000 on a home worth $400,000, your LTV is 75%. A high LTV means you have less equity in your home. A low LTV means you have more. Lenders use LTV ratios as a one way to assess your borrowing power.

- Origination fee: A lending fee that covers the cost of processing the loan.

- Early closure fee: A penalty for paying off the loan before the end of the term.

Understanding how to leverage your home equity

You can easily calculate your home equity by subtracting the outstanding mortgage balance (or other liens) from the current market value of your home. For example, if you owe $100,000 on a $300,000 home, you would have $200,000 in equity.

Equity = $300,000 - $100,000 = $200,000

You can also use the equity tab in your Realm dashboard to track your equity in real time and to get estimates of how much funding you may be able to access along with current interest rates.

Find out how much equity you've built in your home

Equity is just one part of the equation. Most lenders limit the total amount you can borrow (mortgage plus home equity financing) to up to 85% of your home's value.

So for the above example, your maximum combined debt would top out at 85% of 300,000, or $255,000. Because you already owe $100,000 on your mortgage, you would be able to borrow an additional $155,000 through a secured loan.

Equity borrowing power = $255,000 (85% of $300,000) - $100,000 (outstanding mortgage) = $155,000

Even if you have sufficient equity, you'll need to meet threshold credit scores and DTI ratios, which differ by lender. Transaction (loan) costs also vary—some lenders charge origination and appraisal fees along with closing costs. That's why you'll want to shop around for competitive rates — and to be on the lookout for any "hidden" annual fees and early closure fees.

Again, you can do this right from the equity tab in your Realm dashboard by clicking on the see rates link. You can also talk to a Realm Advisor to discuss your financing options, including the ones discussed below.

Note that equity lending involves using your home as collateral. That means that if you aren’t able to make your loan payments, the lender can foreclose on your home, so be sure to weigh the risks before signing the dotted line.

Home equity financing options

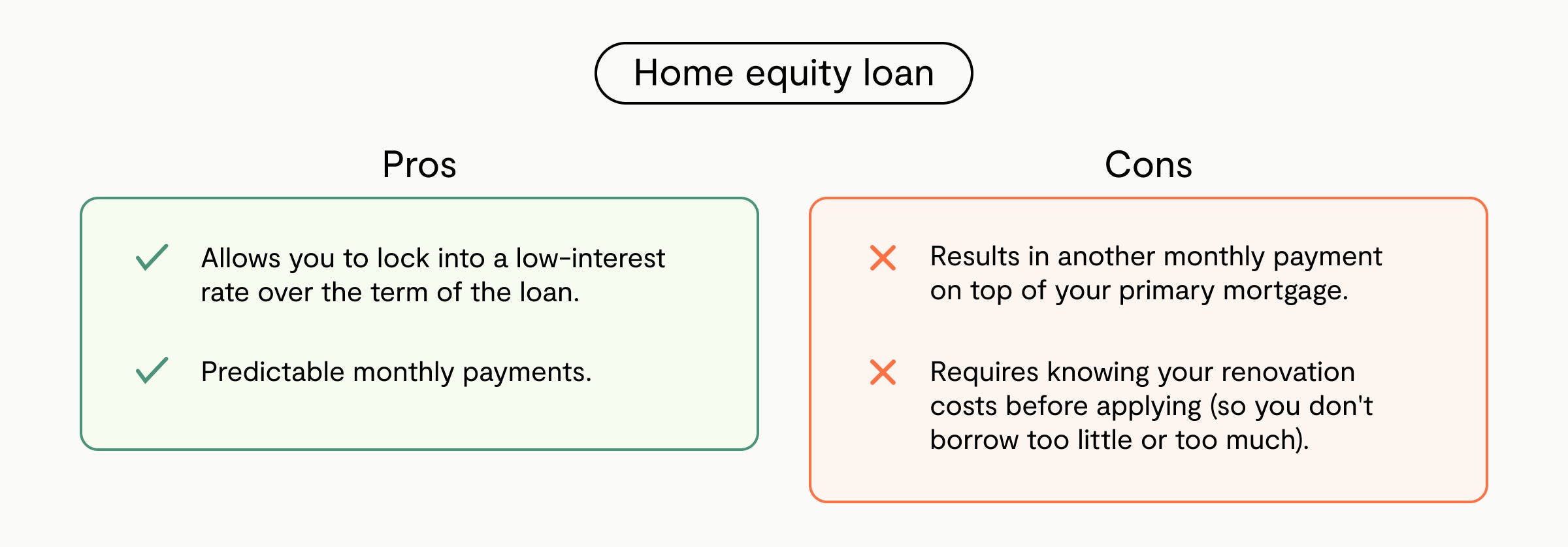

Option #1: Home equity loans

What it is: Similar to a mortgage, a home equity loan is distributed as a lump-sum payment that you repay in fixed monthly installments. In fact, these loans are often referred to as second mortgages. The term length varies from five to 30 years and is typically front-loaded with interest-only payments.

Best if: You’re a credit-worthy homeowner with lots of equity who is looking to fund a major renovation with known costs and need access to the entire loan amount at once, such as to cover hefty upfront expenses.

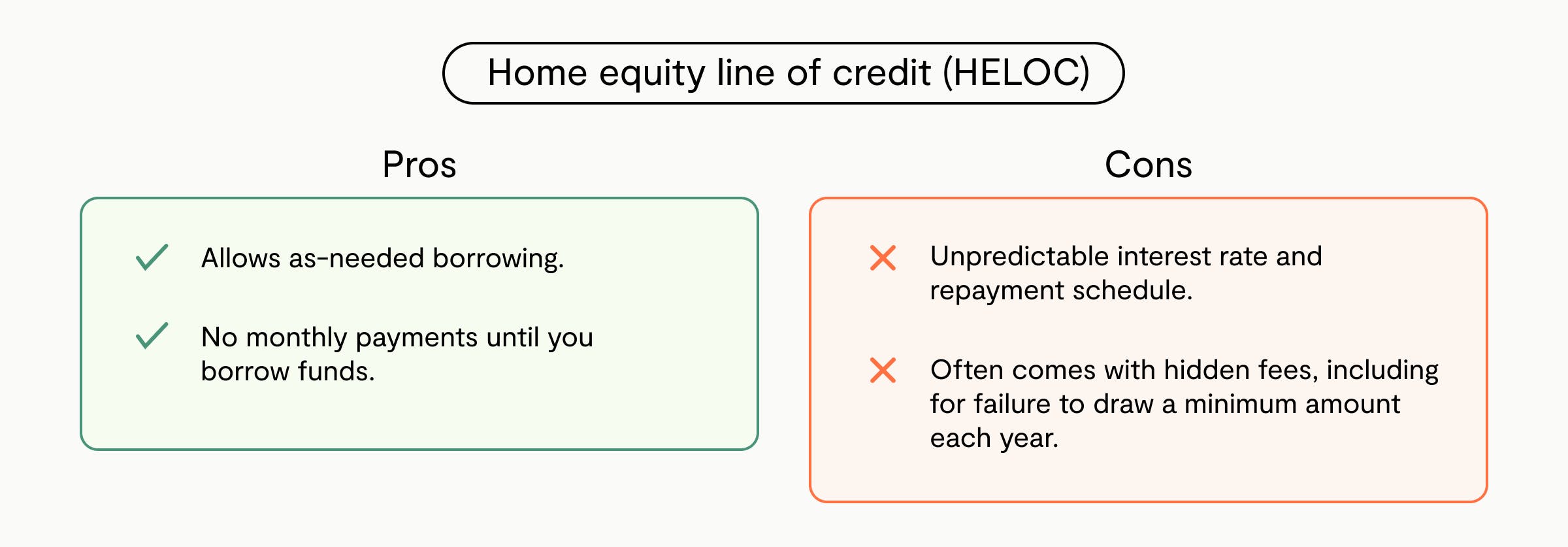

Option #2: HELOC

What it is: A home equity line of credit, or HELOC, is a line of credit that you can borrow from as needed over time, much like a credit card account. HELOCs typically come with a variable interest rate and have a 10-year draw (or borrowing) period with interest-only payments followed by a 20-year repayment period, though those terms can vary.

Because the money is not issued all at once, you only need to repay what you actually use, unlike with a home equity loan. And as you pay the money back, the balance of your available funds goes back up, so you can continue to access those funds throughout the draw period.

Best if: You have strong credit and proof of income and need money intermittently, such as when planning multiple improvement projects over the next five years — or if you aren’t sure what the costs will be.

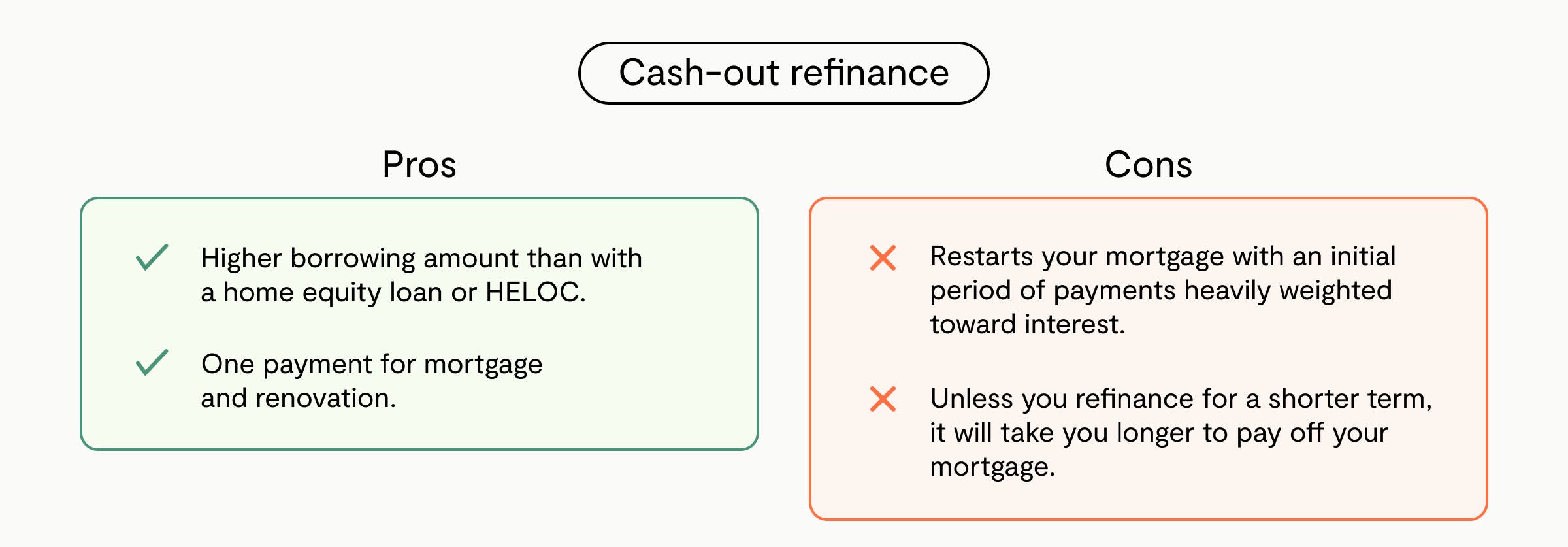

Option #3: Cash-out refinance

What it is: With a cash-out refinance, you’re replacing your existing mortgage with a larger loan based on the current market value of your home. You then get to take the difference between those two loans in a one-time cash payment.

Ideally, your monthly mortgage payment will go down even though the loan amount is larger because you can lock into a lower interest rate, whether because interest rates have dropped or your credit score has improved since applying for your existing mortgage (and therefore, you’re able to get a better rate).

- Realm tip: If you're a veteran, you may qualify for a cash-out refinance offered by Veterans Affairs, which guarantees the loan in the event you can't make the payments.

Best if: Your home has increased in value and you don't want an additional monthly payment like with a home equity loan. Even better if you get a lower interest rate than your current mortgage.

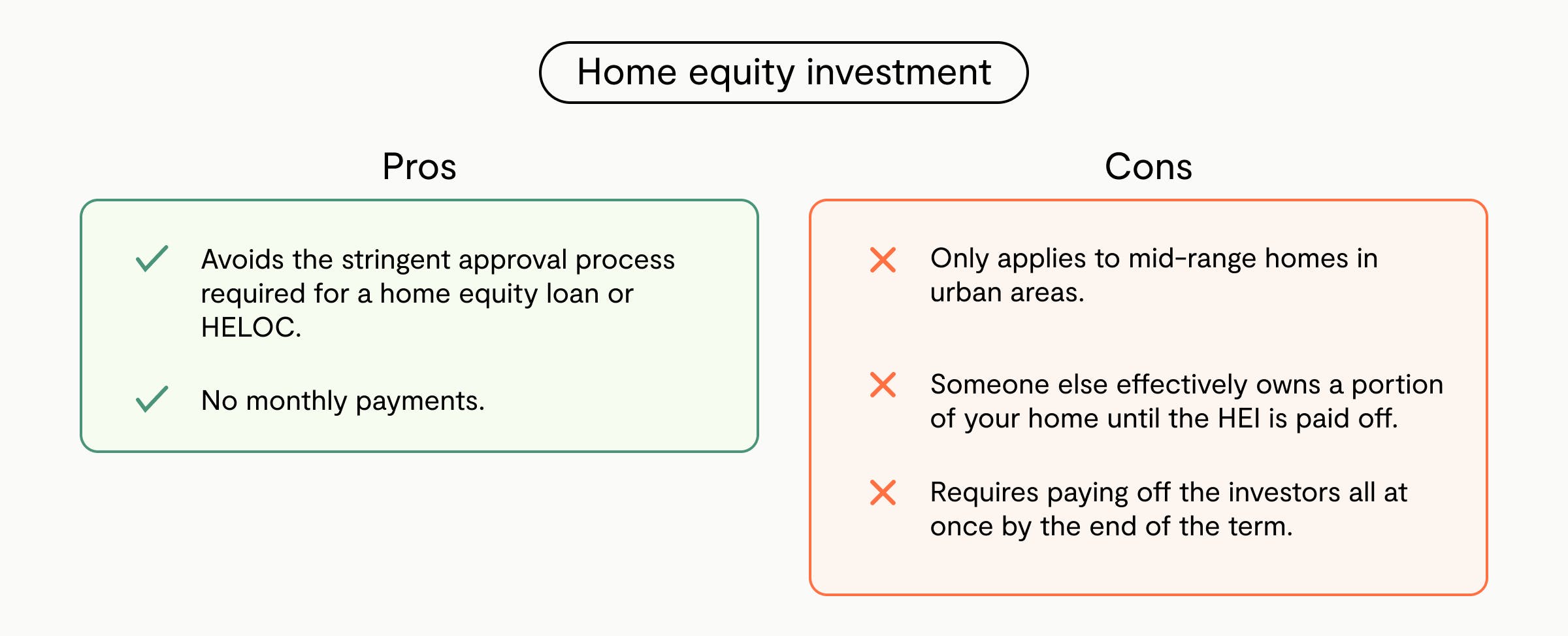

Option #4: Home equity investment

What it is: A home equity investment (HEI) — aka shared equity agreement — is a relatively unknown way to unlock your home equity by giving an investment firm a slice of ownership in your home in exchange for a cash advance. At the end of the investment term (usually 10 years), you will pay back the advance along with a percentage of your home's appreciation.

Know that HEIs are usually capped at around 20% of your equity, far less than other equity financing tools. So if you have $100,000 in equity, you can only borrow $20,000.

Best if: You’re an equity-rich homeowner who might not qualify for home equity loans and HELOCs. (Gig workers and small business owners are a target demographic, especially those who want to avoid taking on additional debt.)

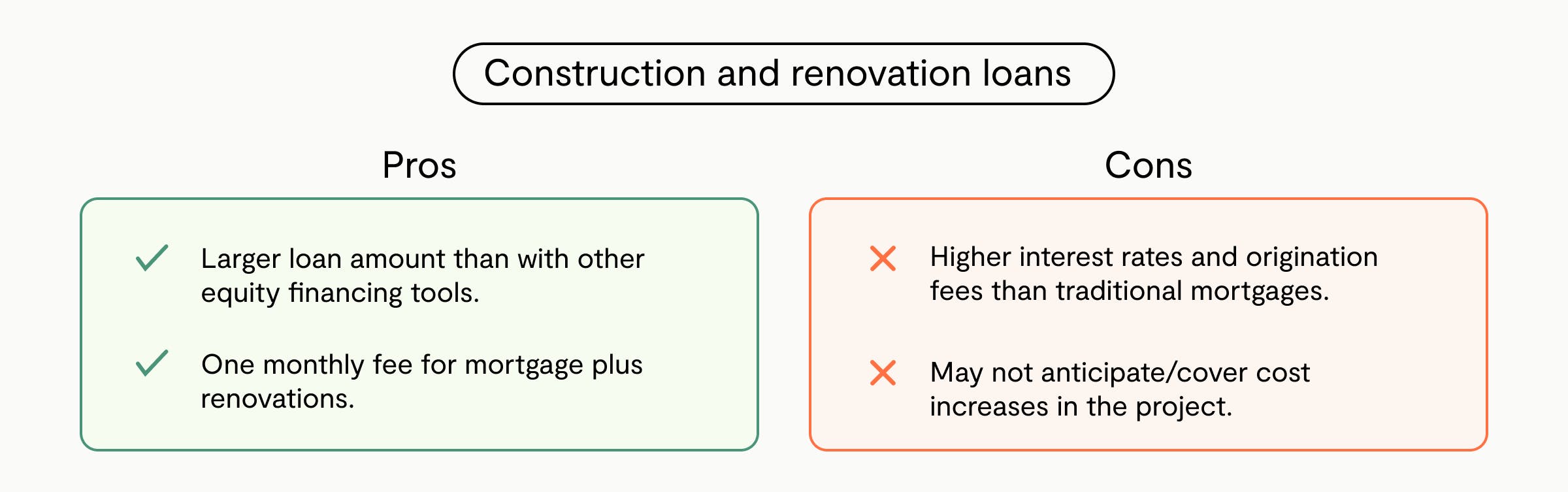

Option #5: Construction and renovation loans

What it is: Construction loans were created for new builds but have now been adapted to finance renovations of existing homes, too. These so-called construction-to-permanent loans allow you to refinance your current mortgage based on the home’s estimated value after improvements are made. The renovation funds are paid directly to the contractor and are tied to project milestones.

Best if: You lack sufficient equity but have a strong credit score and DTI ratio and can lock into competitive rates — and are planning a renovation project with a high ROI.

Head to your Realm dashboard to find out which projects have the highest ROI for your specific property and might be a good candidate for this type of loan. The higher the projected ROI, the more money you may be able to borrow.

Get accurate project pricing and ROI estimates

Government loans

With all of these government-backed options, because the designated government agency "guarantees" the loan (meaning it will pay the lender in case you can't), these loans can be easier to qualify for — even if you don't have lots of equity. Here are three common government loans that specifically cover renovations.

- Fannie Mae HomeStyle Renovation loan: This refinancing loan by the Federal National Mortgage Association (known as Fannie Mae) allows you to borrow up to 75% of the post-renovation value of your home and covers even "luxury" upgrades like swimming pools. The biggest drawback is that the lender must approve your job specs, including design plans and contractors.

- FHA 203(k) loan: The Federal Housing Association (FHA) offers two types of so-called "rehab" loans for eligible repairs: Limited 203(k) loans start at $5,000 and are capped at $35,000 while standard 203(k) loans cover more costly renovations but require a qualified consultant to oversee the project, from start to finish.

- HUD Title 1 Property Improvement loan: The Housing and Urban Development (HUD) loan covers improvements that will make your home "more livable and useful" (excluding luxury improvements). You can borrow up to $25,000 without having any equity. Loans for less than $7,500 are typically unsecured.

Alternatives to equity financing

Equity isn’t the only way to fund home improvements. The following unsecured financing tools rely on your credit scores and proof of income to qualify — and you might get stuck paying higher interest rates. On the plus side, they are much easier to apply for and offer quicker access to funds.

Personal loan: You can get a personal loan from a bank, credit union, or online lender for lots of uses, including home improvements. Because you’re not putting up your home as collateral, these "riskier" (unsecured) loans tend to have shorter terms and lower loan amounts than secured financing tools like home equity loans or HELOCS. Interest rates can be fixed but tend to be higher.

Best if: You have strong credit but no home equity and need to finance smaller projects, such as a bathroom remodel or a new paint job.

Credit cards: What if your boiler needs replacing in the dead of winter? That's when a credit card might come in handy — instant approval and rapid access to funds being the primary goal. Indeed, a credit card can also make sense if you want to fund smaller projects like upgrading your kitchen appliances, but they’re generally used as a last resort to financing options that offer lower (and fixed) interest rates.

Best if: You lack enough equity or income to qualify for other financing options and are only looking to pay for minor projects — or in the case of an emergency.

- Realm tip: If you want to use a credit card to pay for a smaller project, search online for cards that offer a 0% introductory offer, usually for a period of one to six months. But beware of sky-high interest rates once that period ends.

Choosing the right financing option

Now that you have a general understanding of the available financing options, you can begin to match the right one to your planned renovation. Just know it's a two-way street: You'll also need at least a rough estimate of the project costs so you can figure out how much you'll need to borrow.

Planning your projects with Realm can help you do just that. Realm's property-specific ROI estimates give you the data you need to make the hard decisions. What's more, our cost estimates use local figures to give you an accurate sense of what a project will cost in your specific area.

Whichever project you decide to tackle, it's good to know there are many financing tools to choose from. Leveraging your equity is by all accounts the most cost-effective approach, with lower interest rates than unsecured financing options. Plus you'll be able to unlock your home equity to make improvements, which will in turn build even more equity. It’s a win-win!

Here's a cheat sheet for financing tools that leverage your equity:

- A home equity loan is best when you know how much you need and plan on using the lump-sum payment within a specific time (and can afford the extra monthly payment).

- A HELOC offers more flexibility in that you can borrow money as you go, but you have to swallow the idea of adjustable interest rates.

- A cash-out refinance offers a middle ground — you get access to all the money all at once and avoid an additional monthly payment. Bonus: Time it right and you can lower your mortgage payments by locking into a lower interest rate.

Ready to get started? Head to your Realm dashboard and start planning your renovation today.

Published by Realm

Get more out of your biggest asset: your home. Realm shows you what your home could be worth & how to access more of its potential value. View more posts